Small Business Federalism: the State Small Business Credit Initiative

Below is the Nowak Metro Finance Lab Newsletter shared biweekly by Bruce Katz.

Sign up to receive these updates.

November 2, 2023

(co-authored with Bryan Fike and Colleen Dougherty)

It is a curious moment for small businesses in America. More than three years after small businesses were a key pillar of the initial response to COVID-19, small businesses are now grappling with third and fourth order consequences from the pandemic. Supply chain challenges and labor market issues remain. Inflation, while easing, remains high. And today’s elevated interest rates meant to stem inflation have brought about a credit crunch and increased borrowing costs. In venture capital markets, we are witnessing a pullback in activity.

The impacts of these challenges are being borne disproportionately by entrepreneurs of color and other disadvantaged firms. Black and Latino owned firms — while driving a near-record pace of business formation[1] — now struggle even more to access credit markets. In the venture capital world, people of color already represented a tiny share of VC fund managers and VC-backed entrepreneurs. These challenges will not be helped by recent legal activity against the Fearless Fund, the SBA’s 8(a) program, and the Minority Business Development Agency, spurred on by the Supreme Court’s affirmative action decision, targeting programs that aim to support entrepreneurs of color.

Meanwhile, the country is in the early stages of a major industrial transition. While large manufacturing activity is located at the periphery of metropolitan areas and risks bypassing cities and the firms that call them home, we remain hopeful that it subsequent waves will generate a surge in demand and growth opportunities for small business.

Small business federalism to the rescue?

Fortunately, the State Small Business Credit Initiative (SSBCI) is here to help. Enacted as part of the American Rescue Plan Act (ARPA) in 2021, the program offers a range of equity, credit support, and technical assistance programs to bolster small businesses. Despite a $150 million recission as part of debt ceiling negotiations, SSBCI still provides nearly $10 billion, including $2.5 billion for firms owned by socially and economically disadvantaged individuals (SEDI) and $500 million for very small businesses with fewer than 10 employees. SSBCI also aims to crowd in private capital, with a 1:1 initial private match requirement and a long-term goal of 10:1 private-public leverage over the life of the program.

Funded by a federal appropriation and overseen nationally by the Treasury Department, the program is administered by states, territories, and Tribal governments within shared sttutory and programmatic frameworks. These jurisdictions design SSBCI credit and equity programs and partner with a range of entities at the local and regional levels to deploy funds to entrepreneurs and enterprises.

While the challenges small business face are numerous in number and type, SSBCI’s design – what we call a type of small business federalism – offers jurisdictions a high degree of flexibility to address them.

The program’s history bears this out. Initially conceived in response to tightened credit markets for automotive industry suppliers amid the Great Recession, the first iteration of the program also went on to support expanded access to venture capital in historically overlooked regions beyond the coasts. Now rebooted as SSBCI 2.0 under ARPA, the program aims to mitigate the small business impacts of the pandemic and address historic failures to invest in disadvantaged firms and founders.

The program’s federalist design also makes it adaptable to a host of priorities, strategies, and deployment approaches among administering jurisdictions. As we wrote in January[2], there is an enormous level of variation across jurisdictions in the who, what, and how of SSBCI. Some states aim to bolster innovation economies, manufacturing, and decarbonization efforts, while others have placed greater emphasis on supporting local-serving firms. Among $8.3B allocated for SSBCI programs approved by Treasury as of June 2023, approximately 61% was designated for credit support programs – which generally support Main Street, manufacturing, and supplier firms – with the remaining 39% designated for equity and venture capital-oriented programs supporting the innovation economy. Deployment approaches – the techniques used to facilitate the flow of capital from jurisdictional governments to entrepreneurs and enterprises — vary from centralized to highly distributed.

Missouri and Kansas: early signals on SSBCI

While state and local governments and transit agencies face a looming fiscal cliff as other ARPA-funded relief programs expire in 2024, we remain in the early stages of SSBCI implementation. Treasury recently approved the final state SSBCI plans and is now beginning to announce approvals for territories and Tribal governments, with 39 Tribal government applications approved for up to $73 million total. As of June 2023, jurisdictions had expended, obligated, or transferred $713 million in SSBCI funds. Three states have received their second of three funding tranches from Treasury (with more nearing it), while others remain focused on bolstering administrative capacity, onboarding deployment partners, and raising awareness of their programs with outreach and marketing efforts.

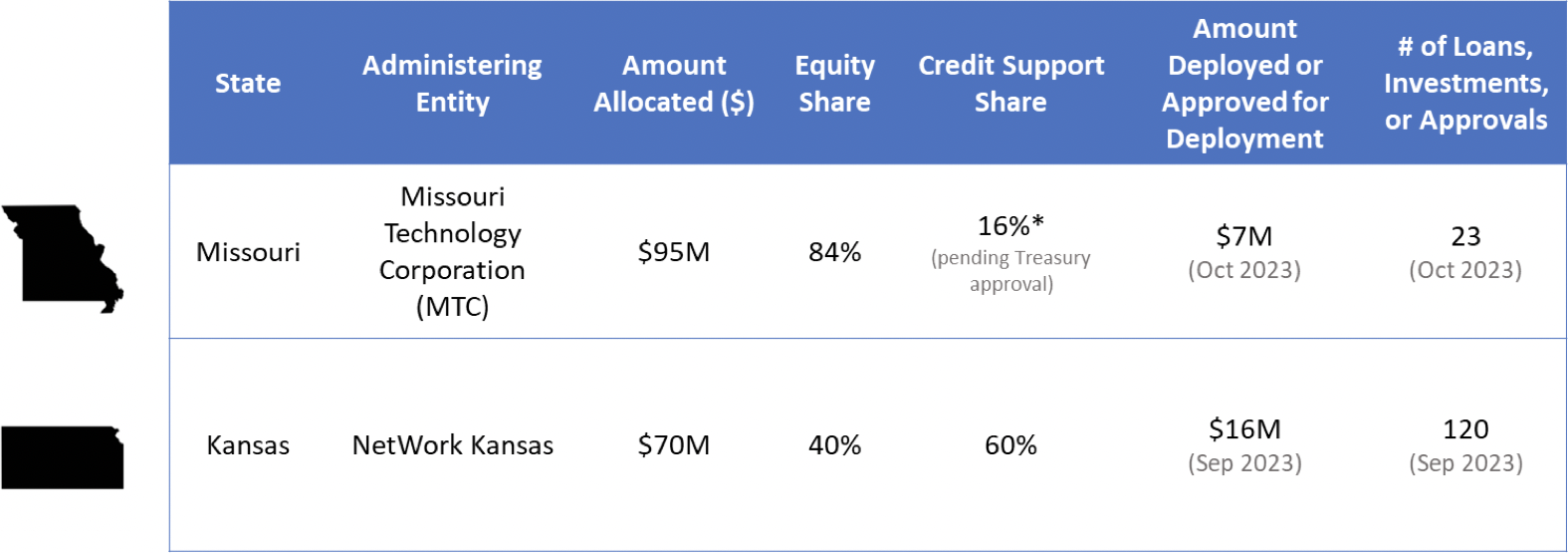

Accordingly, we do not yet have comprehensive data on SSBCI-funded deals from Treasury for a national picture of program implementation. Nonetheless, we review publicly announced deals from two neighboring states — Missouri and Kansas — for a snapshot of two distinct types of strategies emerging from SSBCI loans and investments.

Missouri – bolstering strategic sectors in the innovation economy

The Missouri Technology Corporation (MTC) – a public-private entity established by the Missouri legislature to foster tech-based economic growth – administers SSBCI for the state. MTC is dedicating a significant portion of its $95 million in SSBCI funds to advance key traded-sector industries and strengthen its position as a hub in the innovation economy.

Missouri awaits Treasury approval for its $15 million loan participation program for SEDI-owned firms, targeted to launch in early 2024. In the meantime, its venture capital activities are off to a fast start. Through its IDEA Fund (Innovation, Development, and Entrepreneur Advancement) Co-Investment Program[3], MTC makes equity investments in early-stage, Missouri-based tech companies. The IDEA fund aims to foster the establishment and expansion of businesses involved in translating science and technology into jobs and economic growth.

MTC’s SSBCI efforts are informed by a 10-year strategic plan, called Catalyzing Innovation[4], to support innovation- and entrepreneurship-driven economic development across the state. The plan includes five core strategies, including increasing funding for entrepreneurs, improving access to entrepreneurial support services, and strengthening technology transfer and research commercialization, among others. MTC’s SSBCI allocation is a key piece of its implementation plan and will allow it to significantly accelerate its efforts to fund entrepreneurs[5]. In FY 2024 (July 2023 – June 2023), MTC aims to invest $8 million to $10 million of its SSBCI funds in approximately 30 companies.[6]

This is familiar territory for MTC. The initial iteration of SSBCI, spanning from 2011 to 2017, helped MTC launch the IDEA Fund. In SSBCI 1.0, MTC invested upwards of $25 million across 80 companies via the fund. These firms have since secured over $760M in additional private capital, achieving an impressive 29:1 private to public leverage ratio. SSBCI 1.0 took place amid, and likely contributed to, a significant increase in VC activity in the state: according to TEConomy Partners’ analysis of Pitchbook data, VC investments grew from $137 million across 32 deals in 2010 to nearly $500 million and 160 deals in 2017.

MTC’s SSBCI 1.0 efforts were particularly successful in the life science, SaaS, and AgTech industries. Its portfolio companies included Confluence Life Sciences, a biotech company focused on inflammatory and immunological disorders and cancer, with a reported valuation of over $1B; Gainsight (previously Jbara Software), a customer success platform acquired for $1.1B; and CoverCress, a seed technology company that converts field pennycress, a winter weed, into a source of feed and biofuel.[1]

Missouri’s initial SSBCI 2.0 deals suggest that it is once again on a promising path. As of this writing, MTC has announced allocation approvals for more than $7 million in SSBCI funds across twenty-three direct VC investments. Its investments are sourced through a robust network of regional entrepreneurship “nodes”, accelerators, sector intermediaries, research universities, and industry partners. Entities like BioSTL, the Cortex Innovation District, 39 North, and Arch Grants in St. Louis, and BioNexus KC (the lead entity for the recently-designated “Inclusive Biologics and Biomanufacturing” Tech Hub), Digital Sandbox KC, SourceLink, and Launch KC in Kansas City play critical roles in the state’s entrepreneurial ecosystems. In addition to investing in firms directly, MTC also supports the ecosystem more broadly – its Missouri Building Entrepreneurial Capacity (MOBEC) program, for example, funds entrepreneurial support organizations throughout the state, and its Physical Infrastructure Grant program funds facilities and infrastructure for new ventures.

As is common in the innovation economy, MTC’s SSBCI 2.0 deals demonstrate sector and geographic clustering. Biotechnology, life sciences, software, and AgTech again feature prominently in MTC’s SSBCI portfolio. Geographically, its deals are clustered in cities and metropolitan areas. Fourteen companies are located in the St. Louis metro, four are in greater Kansas City, and two are in Columbia, MO – home to the University of Missouri.

Selection of investments and approvals from MTC’s SSBCI 2.0 portfolio

Kansas – building network capacity

NetWork Kansas administers the state’s SSBCI programs under the GROWKS banner. Established by the Kansas Economic Growth Act of 2004, NetWork Kansas launched in 2006 to promote an entrepreneurial environment throughout the state and to connect entrepreneurs and small businesses with the resources they need to succeed.

Since its launch, NetWork Kansas has developed a network of more than 600 partner organizations across the state, including business chambers, local SBA and USDA arms, and university centers of excellence, among others.[8] In 2007, NetWork Kansas developed its first E-Community (entrepreneurship community) partnerships, enabling local leadership teams to administer local loan funds in collaboration with NetWork Kansas.

True to its name, NetWork Kansas is using its SSBCI funds in part to bolster the capacity of its statewide network of partners. NetWork Kansas has identified 40 partners – including 31 E-Communities, along with banks and certified development companies – to “import decision-making” and source deals for GROWKS loan programs. On the equity side, 56 partners, including accelerators and economic development organizations, provide deal referrals. Of its $69 million SSBCI allocation, $42 million is planned for loan programs and $27 million for equity programs.

A notable partnership with the Kansas Health Foundation has helped NetWork Kansas launch its Community Equity Ownership Program. That program has secured matching funds from the foundation’s endowment – not grant or PRI dollars – to invest in five firms thus far. This represents a significant departure from business as usual. While in most cases philanthropic endowments are invested via large national asset managers, NetWork Kansas and its partners have created a pathway for those funds to strengthen the state’s entrepreneurial ecosystem.

Kansas’ distributed approach to SSBCI has allowed it to quickly source and fund deals. After receiving Treasury approval in May 2022, GROWKS loan and equity programs had by the end of calendar year 2022 approved or funded 28 businesses for more than $3.2 million in capital. These deals leveraged more than $12 million in private funds. By September 30, 2023, 120 businesses throughout the state had been approved for SSBCI funds, leveraging more than $60 million in private capital.

The state’s widely distributed delivery approach has also resulted in funds flowing to firms widely distributed across industries and geographies. In total, more than 35 separate industries are represented among the deals, including local-serving or “Main Street” businesses, supplier firms, and high-growth startups. These include mechanics, restaurants, coffee shops, salons, and pet care businesses, among local-serving firms; supplier businesses like a metal coating company, manufacturers, a printing company, and a trucking firm; and a range of tech and tech-enabled firms in the high growth economy.

We see a similar distribution geographically. Firms from more than 40 cities and towns in Kansas have received SSBCI loans or investments. Among publicly announced loans and investments, approximately 60% have gone to metro areas (i.e., MSAs), while the remainder have gone to non-metropolitan communities.

Selection of investments from NetWork Kansas SSBCI 2.0 portfolio

Maximizing the federalist small business program

Missouri and Kansas exemplify just two of the many types of strategies and deployment approaches we expect to see from SSBCI. As more comprehensive program data from the Treasury Department is published, we will continue to track how SSBCI’s small business federalist approach impacts distinct segments of the economy and diverse types of firms.

In the meantime, several themes emerge from our review of these two states:

Have a plan and align resources with it — Missouri and Kansas demonstrate how states can align their capital programs with strategic priorities. In Missouri’s case, an innovation economy requires innovation-oriented capital (i.e., early-stage venture capital). Kansas’ efforts to reach broadly distributed firms require a broad spectrum of capital, from credit support to venture capital.

Capital is critical, but insufficient on its own — both MTC and NetWork Kansas offer a range of entrepreneurial and small business support programs alongside loan and investment capital, like MTC’s MOBEC and physical infrastructure programs, and courses, bootcamps, and coaching events supported by NetWork Kansas. These programs are key to strengthening entrepreneurial ecosystem infrastructure and developing dealflow.

Networks are key — regardless of their goals, states must rely — directly or indirectly — on networks of institutions and intermediaries to execute their strategies. While the type of partners (e.g., accelerators and universities vs. banks and regional loan committees) and the nature of partnerships (e.g., building pipelines of firms vs. underwriting deals) may differ, their importance is undeniable. These networks require sustained and deliberate efforts to establish and maintain them — in the case of both MTC and NetWork Kansas, they are nearly two decades in the making.

These are observations of a federalist program in its early days of implementation. As market dynamics shift and other federal funds flow, we expect SSBCI to evolve alongside them.

Note: The Nowak Lab is tracking publicly-announced SSBCI deals from jurisdictions and news sources. A detailed tracking tool is expected to be made public in the coming weeks.

About this map: This map contains publicly announced State Small Business Credit Initiative (SSBCI) loans and investments tracked and broadly categorized by the Nowak Metro Finance Lab. Deals are sourced via jurisdiction websites, press releases, and news outlets. They are broadly classified as manufacturing, supplier (i.e., B2G/B2C), “Main Street” (i.e., local-serving firms), and high growth (e.g., technology) businesses.

Disclaimer: This map is not a comprehensive or authoritative listing of all SSBCI loans and investments. Many jurisdictions and their partners may not release information about SSBCI loans and investments, and many publicly announced deals may be omitted. Comprehensive information will be released by the U.S. Treasury Department. This map is intended for illustrative purposes only. It provides examples of firms that have received SSBCI loans and investments and is intended to highlight the range of firm types that are using program funds. The map should not be used to evaluate the performance of any participating jurisdiction or entity. What have we missed? Are you aware of publicly-announced SSBCI loans and investments that are not included on this map? Let us know: csd77@drexel.edu

Bruce Katz is the Founding Director of the Nowak Metro Finance Lab at Drexel University. Bryan Fike and Colleen Dougherty are Research Officers at the Nowak Lab. Arianna Bollens, a summer 2023 Research Analyst at the Nowak Lab, provided valuable research assistance that informed this piece.

[1] https://www.forbes.com/sites/elizabethmacbride/2023/03/17/meet-the-owens-of-frankfort-ky-they-help-explain-americas-great-small-business-surge/?sh=5f23eb3113ba

[2] https://drexel.edu/nowak-lab/publications/newsletters/ssbci-where-we-stand/

[3] https://www.missouritechnology.com/venture-capital-investments/

[4] https://www.missouritechnology.com/catalyzing-innovation/

[5] https://www.bizjournals.com/stlouis/inno/stories/news/2022/10/26/missouri-technology-corp-ssbci-funding-95-million.html

[6] https://www.missouritechnology.com/wp-content/uploads/2023/09/MTC-Implementation-Plan-FY24.pdf

[7] https://www.missouritechnology.com/wp-content/uploads/2022/11/2022-mtc-gov-conf-presentation-220901-updated.pdf

[8] https://www.networkkansas.com/wp-content/uploads/2023/02/NetWork-Kansas-Annual-Report-fy-2022_FINAL-Digital-1.pdf