Using Defense Spending to Grow Local Businesses: Insights from El Paso

Below is the Nowak Metro Finance Lab Newsletter shared biweekly by Bruce Katz.

Sign up to receive these updates.

March 21, 2024

(co-authored with Milena Dovali)

As the United States faces escalating tensions across the globe, the modernization and transformation of our military has become an urgent concern. In response, the Department of Defense’s budget has increased significantly in recent years. In FY 2023, Department of Defense Appropriations totaled $797 billion, marking a nearly 10 percent increase over the previous fiscal year. These appropriations are critical for the United States and our allies to advance critical security objectives; they also have a sizable impact on communities across the nation, given how spending on personnel and contracts is recycled in metropolitan economies. This phenomenon, which we term the Defense Dividend, presents a unique opportunity for local and state leaders to use federal spending to drive economic growth, foster high-quality employment, and accelerate innovation.

The potential to use defense spending to grow local businesses is of particular interest. Of the total $797 billion appropriated in FY 2023, $233 billion were used by the Department of Defense (“DOD”) to purchase a broad array of goods and services, providing a large and stable customer base. The sheer volume and variation of what the military buys means that suppliers range from major defense contractors like Lockheed Martin, Boeing and Huntington Ingalls (which, through intricate supply chains, are building the next generation of warships, fighter jets, and nuclear-powered submarines) to small local businesses that have the capacity to, among many things, manufacture military uniforms, build and maintain military housing and support military bases.

As recently reported, we had an opportunity to work with a network of public, private and civic leaders in El Paso over the past year in an effort to maximize the local impact of their sizable procurement economy. This effort, a Rockefeller Foundation supported collaboration between the Nowak Metro Finance Lab at Drexel University and the Aspen Institute’s Latinos and Society Program, naturally included a substantial focus on DOD spending given that El Paso is home to Fort Bliss, the largest installation in the United States Army Command. Remarkably, Fort Bliss has a total land mass of 1,700 square miles, larger than the entire state of Rhode Island.

As part of the Supply El Paso project, we created a diagnostic tool that enables a community to understand both the scale and sectoral focus of DOD procurement and the extent to which current spending is being used to grow local businesses. This tool provides a solid foundation for communities to go further and work with DOD and local business ecosystems (e.g., chambers of commerce, entrepreneurial support organizations, financial institutions, local governments and universities) on intentional efforts to grow local businesses. We believe that our work in El Paso could be a vehicle for a broader national initiative to unlock the full local potential of defense spending given that we use a national data platform that is annually refreshed and DOD has a series of tried-and-true strategies that could be scaled and adapted across the country.

Navigating Defense Spending: Insights from USAspending.gov

USAspending.gov, established in 2007 under the Federal Funding Accountability and Transparency Act (FFATA), is a publicly accessible website designed to enhance transparency and accountability in U.S. federal government spending. Through its searchable database, users can easily track and analyze various government expenditures, including federal contracts, grants, loans, and other financial assistance. For contracts alone, one can examine information on 286 different variables, which include detailed information on both recipients and contracts. For recipients, this encompasses general details such as name, contact information, location (from state to zip code), along with specifics regarding the type or size of the business and whether it is minority-owned, woman-owned, or veteran-owned. Concerning contracts, this information encompasses the awarding agency, essential dates, funding sources, sector specifics, and detailed financial information, including award amount, obligated amount, and outlayed amount, thereby enriching the analysis of the contract’s financial aspects.

DOD Spending in El Paso: A comprehensive analysis

To analyze direct federal spending in El Paso, we extracted data on all awarded contracts where El Paso County was the primary place of performance. In 2022 alone, this yielded nearly 20,000 contracts. To analyze the specifics of DOD spending in El Paso, we looked at contracts awarded by this agency and divided our analysis into three main aspects: sizing the federally supported procurement economy in El Paso, identifying top sectors, and assessing local leakage.

1. Sizing the Procurement Economy in El Paso

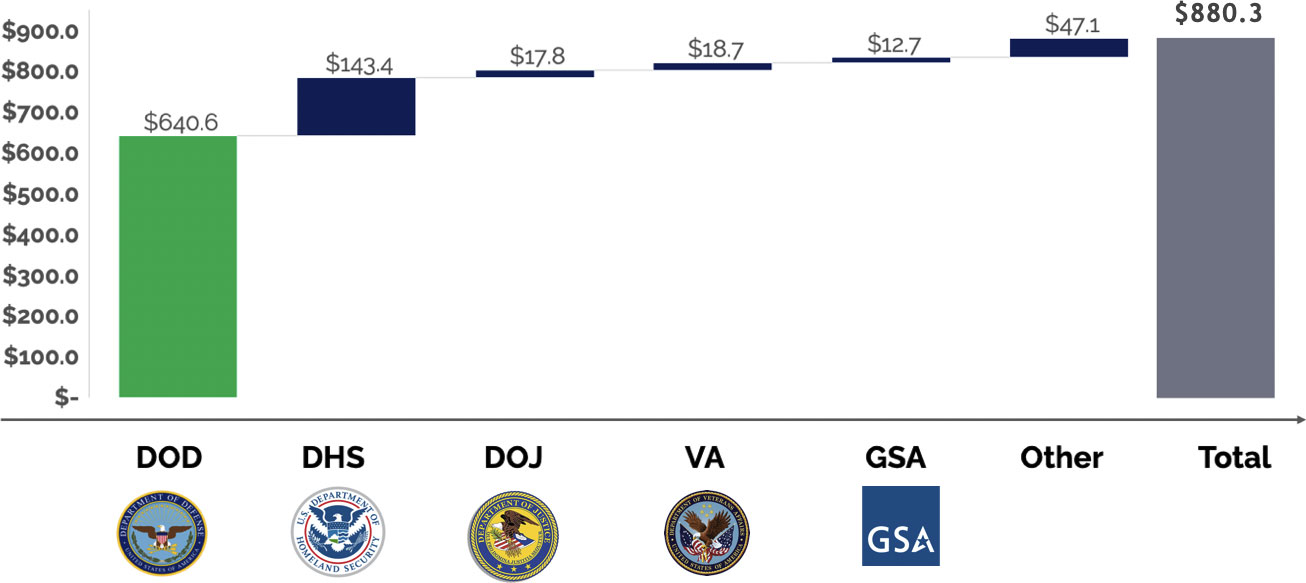

To understand the business prospects tied to federal spending, it’s crucial to assess the scale of the opportunity. This involves aggregating the total value of federal contracts awarded in El Paso County and determining the share allocated by the Department of Defense. To mitigate biases stemming from outliers, we conducted our analysis based on a five-year average spanning from 2018 to 2022. Our findings indicate that approximately $880 million is procured annually in El Paso by the federal government, with a substantial portion, amounting to $640 million, attributed to the Department of Defense. DOD’s procurement represents a significant 72% of direct federal spending in the region, illustrating the profound impact of defense spending on the local economy.

Chart 1. Direct Federal Spending* in the El Paso County by Agency (in Millions of Dollars)

Note: The term “direct federal spending” here refers specifically to contracts awarded by federal agencies to be performed in El Paso. However, it does not encompass spending on personnel. Additionally, we calculated a five-year average of the total sum of amounts from these contracts spanning from 2018 to 2022.

2. Top Sectors Analysis

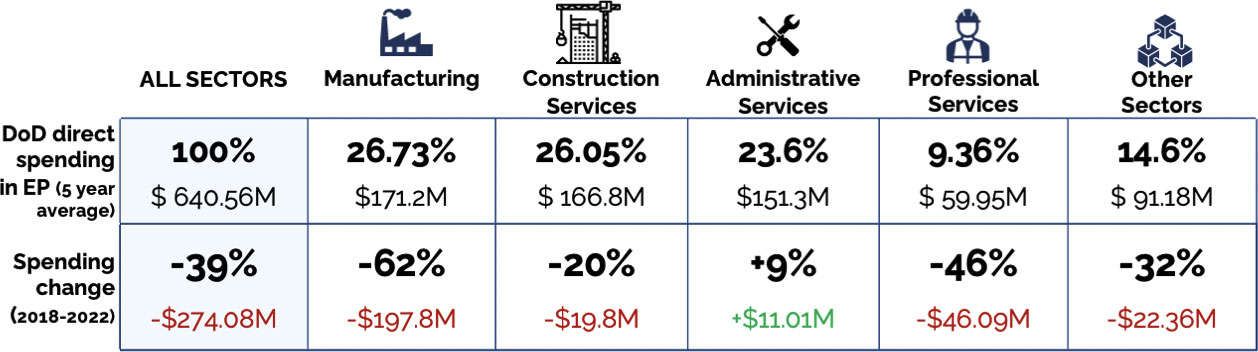

Understanding Department of Defense spending goes beyond just assessing its overall magnitude. It involves identifying the key sectors where the funds are allocated, shedding light on the specific industries and types of businesses that the federal government offers opportunities to. By leveraging the data provided by six-digit NAICS codes associated with each contract, we conducted a comprehensive sector breakdown (see chart 2), revealing that manufacturing (26.7%), construction (26%), administrative services (23.6%), and professional services (9.3%) emerge as the sectors with the highest aggregated spending.

Examining the five-year average revealed significant sector trends, notably the rise of administrative services as the predominant sector since 2020 (increasing by 9% from 2018 to 2022). This rise contrasts with the declining prominence of manufacturing, where total spending decreased by 62% during the same period. A closer analysis shows that administrative services are mainly associated with the operation and maintenance of Fort Bliss, highlighting the pivotal role of military assets within regions like El Paso County.

Chart 2. DOD Spending Breakdown by Sector with Five-Year Change (2018-2022)

Note: This chart presents two distinct aspects of spending trends. The first row displays the five-year average (2018-2022) spending in top sectors reported by DOD. Conversely, the second row showcases the corresponding change in spending (in dollars and percentages) from 2018 to 2022 in those same sectors.

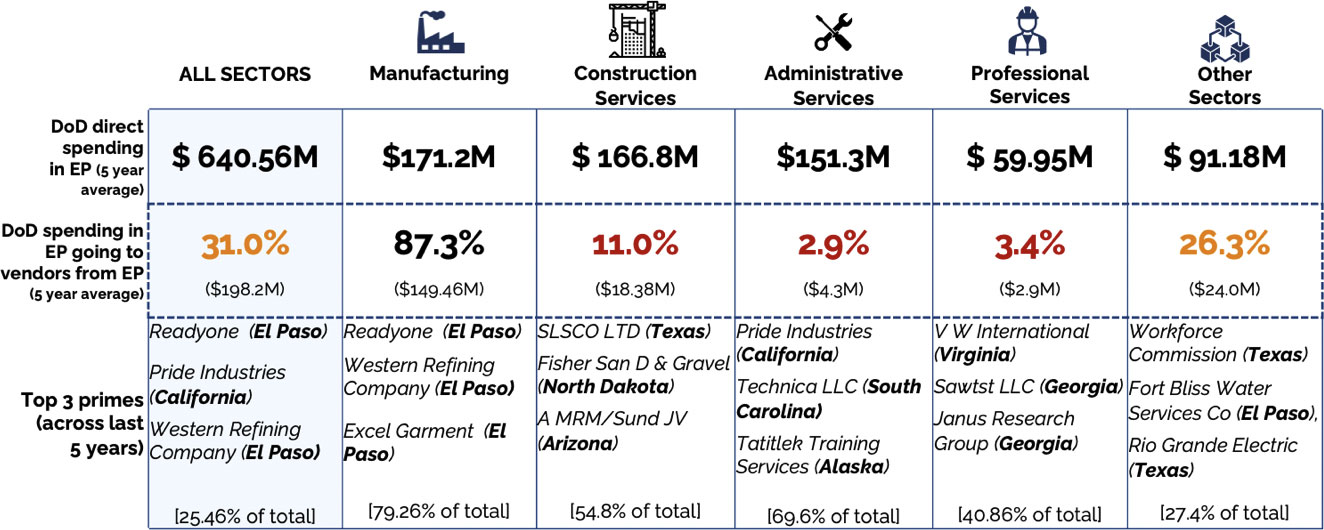

3. Local Leakage

El Paso’s proximity to Fort Bliss would suggest a natural advantage in benefiting from the influx of spending into the county. However, to truly understand the extent of this benefit, we measured the proportion of Department of Defense spending allocated to firms not headquartered in El Paso County—a phenomenon we’ve termed “local leakage” (see chart 3). What we found was surprising: seven out of every ten dollars of DOD spending flow to prime contractors situated outside the county. These prime contractors might engage local firms as sub-contractors, potentially mitigating some of the local economic leakage. However, without access to this data, we are unable to definitively assess this potential mitigation.

This revelation becomes even more intriguing when considering the significant variance in this percentage across different sectors. For instance, as shown in Chart 3, in sectors such as professional and administrative services, only ~3% of spending remains within local firms. Upon closer examination of the top three prime contractors in these sectors, we made a noteworthy observation: they concentrate between 40% and 70% of the spending but are spread across the United States, with operations in states like California, Georgia, Virginia, and Alaska. This geographic dispersion of prime contractors offers a potential explanation for the relatively low local retention rate in El Paso. Conversely, the manufacturing sector emerges as a beacon of local retention, with a remarkable 87% of spending going directly to firms in El Paso—underscored by the presence of specialized firms driving military apparel production and serving as the backbone of this sector’s growth.

Chart 3. DoD Direct Spending and Local Leakage

Note: The top 3 primes were determined by aggregating all contracts from 2018 to 2020 and selecting the firms with the highest cumulative spending across contracts. The percentage at the bottom of the chart indicates the proportion of spending in contracts owned by these firms relative to each sector’s total spending.

Strategies for Maximizing Local Economic Impact

In light of our analysis, it’s evident that the Department of Defense offers substantial economic prospects in El Paso, especially concerning Fort Bliss’s operation and maintenance. However, the critical task ahead is retaining these opportunities within the local community to ensure their benefits are fully realized. To tackle this challenge, the Supply El Paso initiative advocates for two strategies that build upon current DOD efforts to use defense spending to drive small business growth.

The first strategy involves the establishment of Intergovernmental Services Agreements, wherein the DOD delegates part of its procurement obligations to local agencies. By leveraging their proximity to local businesses, these agencies can serve as intermediaries between the DOD and the local business base, driving growth and economic development throughout the region.

The second strategy involves the DoD Mentor-Protege Program. Under this initiative, established defense contractors would mentor firms located in El Paso, providing them with invaluable insights, resources, and guidance to tap into DOD opportunities. Through mentorship, these firms can expand their capabilities, eventually becoming prime contractors themselves. This not only fosters the growth of mentored firms but also enhances the overall competitiveness of the local business ecosystem.

Zooming out, we believe that the diagnostic tools invented for El Paso could, with support from government and philanthropy, become a powerful platform for putting defense spending to work across the country.

The easiest way to do this would be for multiple cities to apply the defense diagnostic to their own communities, working in close collaboration with DOD and the local small business ecosystem. A further step would be to create a national database that enables cities and communities to understand the extent to which defense spending currently supports local businesses and, most importantly, could support the growth of local businesses further with intentional action. Our El Paso work shows that spending and sector information is readily accessible given the national reach and transparency of federal data; taking it to the next level would mean creating a unified portal for this economy shaping and business building information, perhaps starting with the 25 top metropolitan recipients of defense spending.

With such easy-to-access information, DOD could then compare small business participation in defense spending across metropolitan areas. The agency, working with researchers and cohorts of communities, could use data to answer critical questions: to what extent, for example, is small business success a product of sectoral variations, differences in procurement practices, ecosystem engagement or all of the above? Armed with this information, DOD could then work with military communities to codify and adapt proven methods for increasing small business participation.

In sum, the defense dividend is real and substantial and could be furthered with uniform data and purposeful action. The United States should seize the opportunity to use defense spending to amplify small business vibrancy. Marrying national security with local prosperity makes us a stronger nation.

Bruce Katz is the Founding Director of the Nowak Metro Finance Lab at Drexel University. Milena Dovali is a Research Officer at the Nowak Lab.