An era of federal activism raises the potential to use public procurement to grow small businesses and create wealth. To fully capitalize on this potential, we need innovative tools and techniques that turn procurement from an administrative process into an inclusive growth catalyst.

At the Nowak Lab we have developed a Procurement Playbook to seize the moment. These Playbooks size the procurement economy, identify challenges, and offer actionable small business strategies for governments and the broader ecosystem of business chambers, financial institutions, and entrepreneurial support organizations.

We pioneered the Procurement Playbook in two metros (El Paso and San Antonio). Now, for the first time, we’ve adapted it for a state, unveiling the Maryland Procurement Playbook. This project was completed in close collaboration with the Office of Maryland Comptroller Brooke Lierman and supported by a broad network of funders including Johns Hopkins University, the Abell Foundation, CareFirst, T. Rowe Price, BGE, the Annie E. Casey Foundation, and J. P. Morgan Chase.

The Maryland Procurement Playbook comes at a moment of tremendous opportunity, where federal, state, and local spending is at unprecedented levels and can be leveraged to shape markets and foster inclusive growth. But traditional procurement practices will not be sufficient. With legal challenges to race- and gender-conscious programs for small businesses in the wake of the Supreme Court’s decision on affirmative action last summer, solutions are needed that are fit to purpose for the current challenges facing small and diverse firms.

Recognizing the federal government’s significant role in Maryland’s economy through investments in key sectors, Comptroller Brooke Lierman saw the potential for the procurement economy to drive private sector growth. Our task was to develop the Maryland Procurement Playbook, applying successful methodologies from our work in El Paso and San Antonio. This Playbook provides a comprehensive assessment of Maryland’s procurement landscape, offering strategies to build wealth and foster inclusive growth across the state.

The Maryland opportunity is distinct for two reasons:

- The state’s Board of Public Works (BPW), consisting of the governor, state treasurer, and comptroller, is responsible for state procurement policy, procurement regulations, and approval of most contracts exceeding $200,000; and

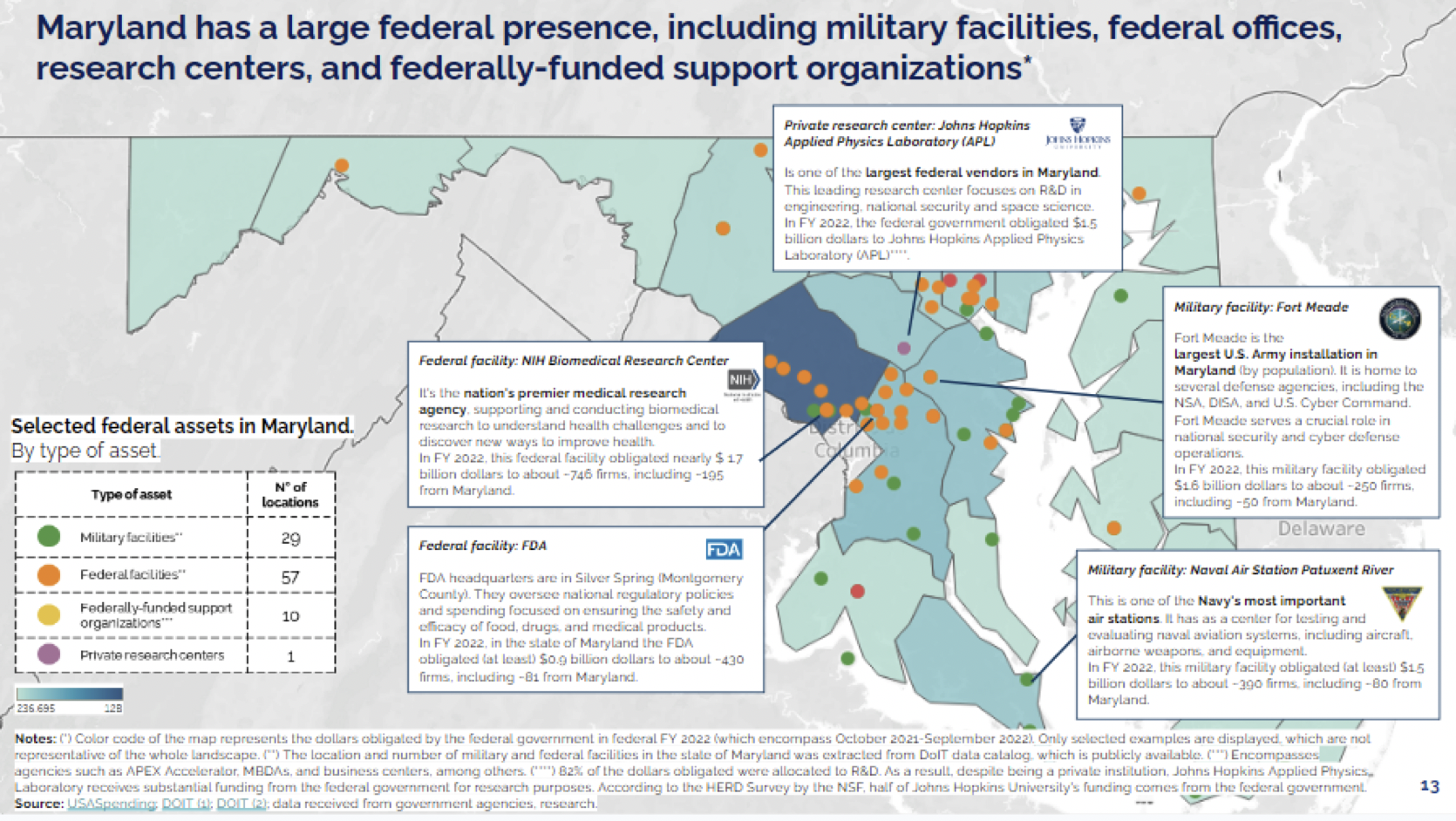

- The presence of federal and military facilities that drive federal procurement activity and an ample supply of federal contractors given the proximity to the nation’s capital.

The core message of the Playbook is that Maryland’s public procurement economy is both super-sized and heavily influenced by the federal purchase of goods and services, particularly in high-paying industries. With the right collaboration and strategies, firms can overcome existing challenges and effectively tap into robust economic opportunities.

Finding: Maryland’s Large & Federated Procurement Economy

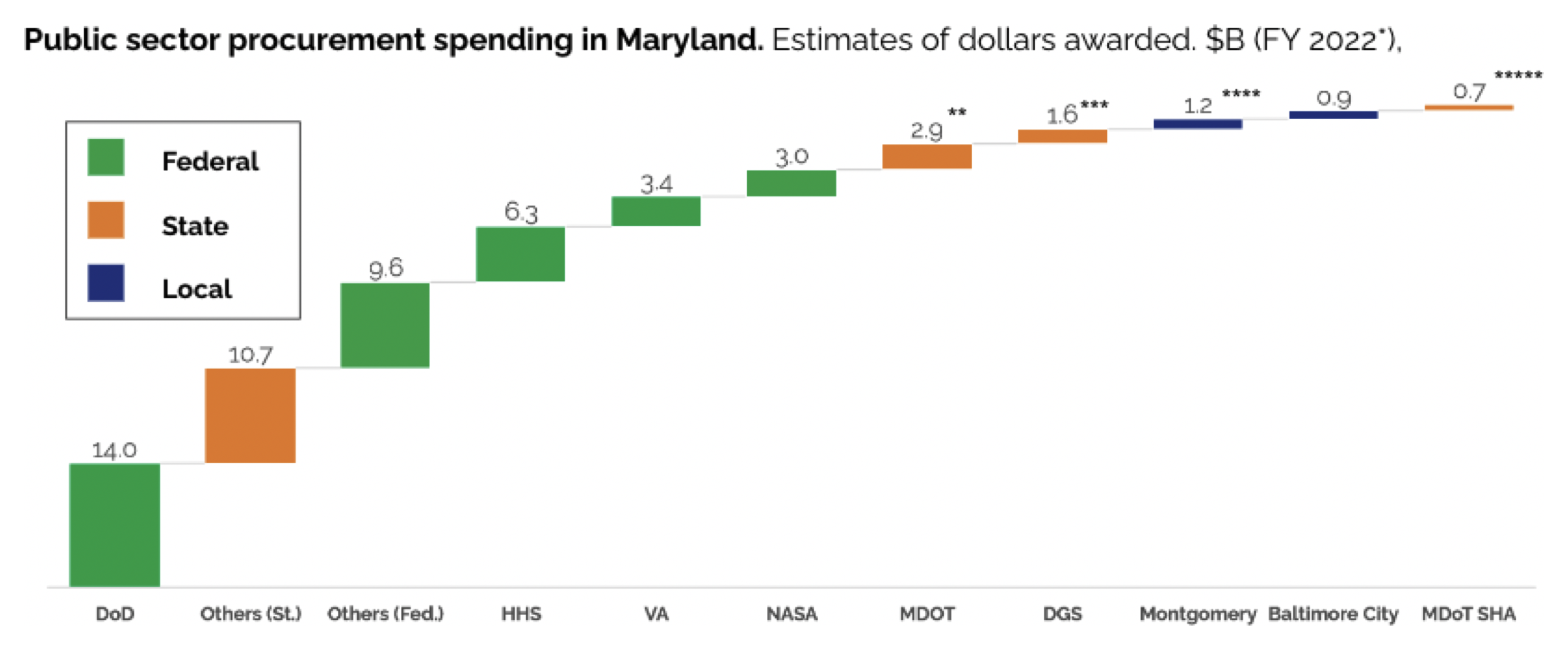

After gathering extensive public and proprietary data, we sized Maryland’s procurement economy and found it to be exceptionally large and thriving. Federal, state, and local agencies, taken together, annually award at least $68 billion in Maryland via contracts to over 9,100 prime vendors, representing 14.2% of the state’s GDP. Additionally, Maryland-based firms receive over $16 billion in federal contracts for work performed in other states, contributing another 3.3% to Maryland’s GDP. Altogether, the public procurement economy in Maryland accounts for at least 17.5% of the state’s GDP. The Department of Defense (DoD) is the largest federal purchaser, spending $14 billion annually.

Maryland’s procurement economy is essential to the state’s economic positioning and growth. Fully leveraging the procurement economy’s potential for Maryland is dependent on ensuring that local vendors can effectively compete for public procurement dollars in the state; we found that roughly 40 percent of state and federal procurement spending for in-state performance is going to out-of-state firms.

The scale of this procurement economy is driven largely by federal contracting given the state’s proximity to the nation’s capital, and the federal presence in the state which includes 29 military facilities and 57 federal offices. We found that the state has nearly 3,300 firms contracting with the federal government, including over 1,000 local firms that have grown their business with the federal government over the last 15 years.

Finding: High-Value Professional Services and IT Sectors Concentration

Not only is the procurement economy in Maryland large, but it has a unique concentration in high-value Professional Services and IT sectors; in CY 2023, the federal government awarded $16.5B and the state government $9.2B for contracts in these sectors. About a tenth of the state’s workforce is employed in the Professional Services sector, above the national average. Maryland is also third among states in Professional and Technical workers. Additionally, our analysis finds that three-quarters of federal, state, and local procurement spending show similarities – the largest of which was in IT, construction, and professional services. Despite that large overlap though, only 2.8 percent of vendors contract with more than one level of government – those who do, capture 16 percent of the total procurement spending in Maryland.

Challenges: Barriers to Firm Participation and Growth

The Maryland opportunity can be summed up as such – the public procurement economy, consisting of federal, state and local spending, is super-sized compared to other states (given the outsized role of federal spending), is concentrated in high-value sectors, and a significant portion of that spending go to out-of-state vendors. In addition, the vast majority of vendors in the state only contract with one level of government, despite there being a diverse base of purchasers across local, state, and federal agencies.

Through firm-centric research, which included engagements with over 40 stakeholders representing firms, entrepreneurial support organizations, advocacy groups, and chambers of commerce, we sought to identify the underlying barriers and challenges that inhibit state-based, women- and minority-owned firms from tapping into the full potential of the procurement economy in Maryland. We identified the following as the most prominent challenges facing firms:

-

The federated procurement system;

-

A fragmented entrepreneurial support ecosystem;

-

Lack of targeted capacity building and capital programs; and

-

Sector-specific challenges in IT and Professional Services

Federated Procurement System

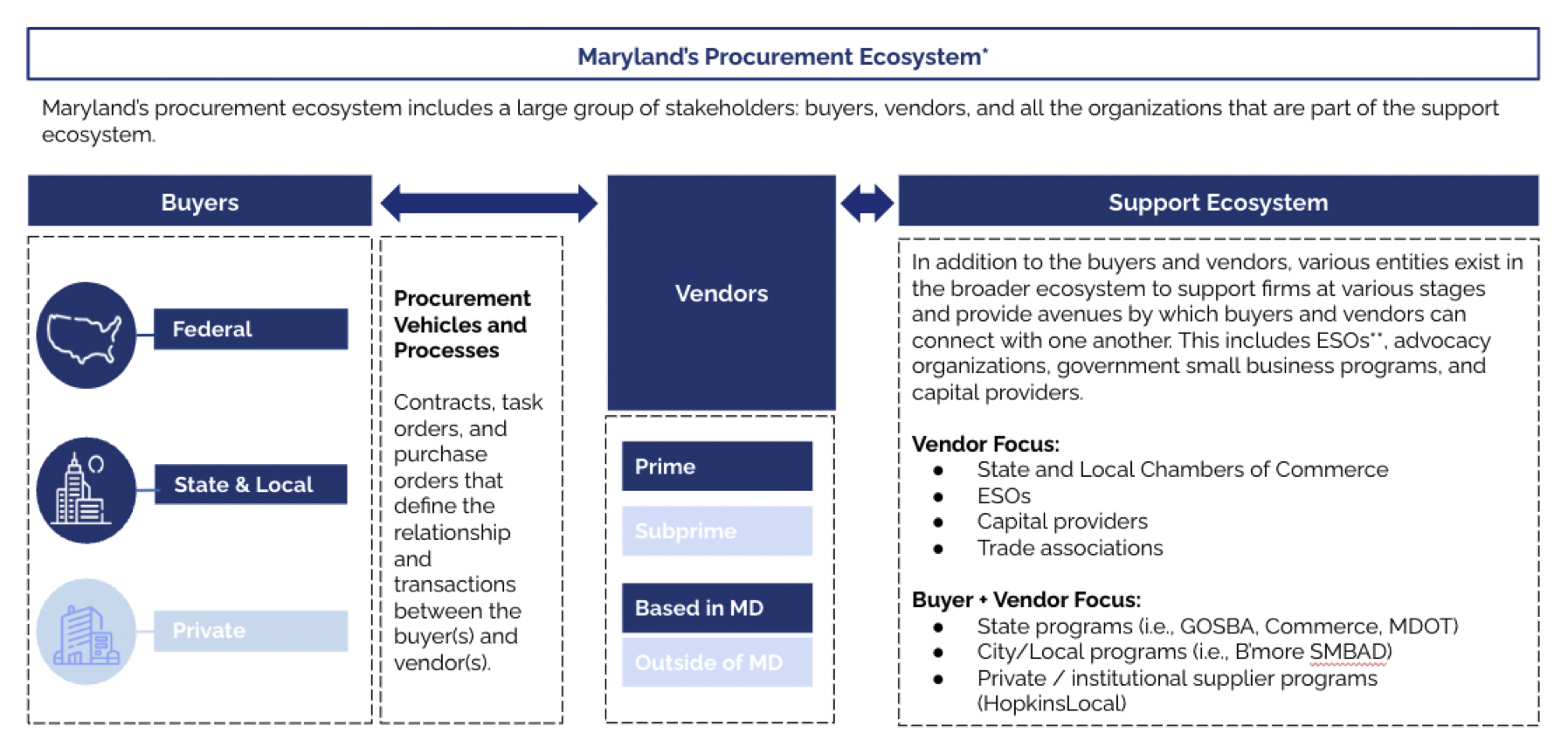

First, we found that Maryland’s procurement economy is truly federated – with over 300 purchasing entities across local, state, and national levels of government, each with a different regulatory and policy regime for procurement, creating three distinct markets within the same geography with artificial barriers inhibiting firm mobility between. The effect is that firms operating in procurement find it more difficult to diversify their customer base across levels of government, which can support stability and growth.

Fragmented Entrepreneurial Support Ecosystem

The procurement ecosystem – inclusive of buyers, vendors, and support organizations – is fragmented with limited coordination, particularly in identifying and addressing resource needs of Maryland-based firms. The separation between buyers across government levels and within the regional support ecosystem, which includes over 90 providers, creates a burden for firms navigating the procurement ecosystem, particularly those that are small and diverse. The distance between these three sets of actors (buyers, vendors, and support organizations) limits potential synergies and collaborative opportunities.

Lack of targeted capacity building and capital programs

The business support ecosystem in Maryland lacks targeted capacity-building efforts and flexible capital programs to introduce and advance firms in the procurement marketplace, posing challenges for MBE firms, particularly in high-growth industries. Support for Maryland vendors focuses on smaller firms, with only a few programs designed to build capacity and scale Maryland-based, mid-size firms. While there are a broad range of services and programs available, less than a third of support providers identified offer procurement-related curriculum business services or programs, and only half of the firms interviewed reported using local or federally funded resources. This gap in targeted capacity building and capital programs limits the ability of firms to enhance their capabilities and navigate complex procurement processes effectively.

Untapped opportunities in Professional Services and IT sectors

In CY 2023, at least $27 billion were awarded by federal, state and local entities to firms in the Professional Services and IT sectors. Over 2,500 vendors served this demand (from in and out of Maryland); we estimated that almost 6 out of 10 dollars spent in Professional Services and IT went to firms outside of the state. Mid-sized vendors based in Maryland in Professional Services and IT reported limited support to connect to more federal opportunities and mentioned that breaking into state procurement could be even more challenging than entering federal procurement. This highlights the need for sector-specific initiatives to boost local participation and address barriers for firms in these high-wage industries.

Collectively, these challenges make it difficult for new firms to enter procurement markets, and for firms, particularly women and minority-owned, to leverage procurement for growth.

Paths Forward

To respond to these challenges, we propose four paths forward in Maryland to create new matching opportunities for firms, direct strategic sectoral growth, remove procedural barriers to competition and enable targeted capacity building and capital access:

Strengthen capacity building and capital programs:

To increase the supply and capability of firms in Maryland, procurement-related business services and programs must be available to all firms at all stages of growth. To achieve this, we propose a state-supported grant resource to strengthen the capacity of business support providers and increase targeted business advisory services to local MBEs entering and growing in Maryland’s procurement economy (with a focus on mid-size firms) that also increases the availability and accessibility of low-cost, low-collateral revolving credit lines and performance bonds.

Develop a navigable and firm-centric ecosystem:

Acknowledging firms’ stated experiences responding to bid requirements and various levels of government, we propose forming a cross sectoral coalition or working group of support and capital providers that serve as an intermediary to coordinate actions and investments of MD support organizations and buyers.

Mitigate barriers to competition:

To increase the number of MD-based firms and MBEs that win prime contracts at the state level, we recommend incorporating firm perspectives directly in ongoing discussions of procurement reform to address causes of complexity in state procurement, particularly relative to local, federal, and peer procurement markets.

Identify high-value sectors and the specific challenges and strategies fit to the sector:

Given the disproportionate volume of public procurement of professional services and IT, we suggest a special consortium of buyers, support providers and Maryland-based firms focused on identifying and tackling regulatory, policy and ecosystem barriers for Maryland firms and MBEs in Professional Services and IT.

Today’s procurement economy can be a catalyst for inclusive growth. To realize that potential, it is incumbent on leaders to undertake a comprehensive assessment of the buyer and supplier sides in procurement, followed by intentional actions to build and leverage capacity.

The Maryland Procurement Playbook provides a model for states to replicate in assessing their state procurement economies across our complex federalist system. In adapting it, states can capture the scale of their procurement economy, identify areas of opportunity as well as the challenges facing firms, and devise actionable strategies for mitigating those barriers so that the procurement economy can become a true catalyst for inclusive growth.

Bruce Katz is the Founding Director of the Nowak Metro Finance Lab at Drexel University. Victoria Orozco is the Founder of the Punto Labs. Milena Dovali, Elijah E. Davis, and Benjamin Weiser are Research Officers at the Nowak Lab.