A Green Business Initiative: How Cities Take Full Advantage of the Energy Transition

Below is the Nowak Metro Finance Lab Newsletter shared biweekly by Bruce Katz.

Sign up to receive these updates.

April 19, 2024

Skyline view of El Paso, TX.

Skyline view of El Paso, TX.

(co-authored with Victoria Orozco)

The energy transition impacts every aspect of the modern economy, driving transformative changes in the nature and location of economic activities. With recent legislation such as the Infrastructure Investment and Jobs Act, Inflation Reduction Act (“IRA”), and CHIPS and Science Act, the U.S. government is investing at record levels to expedite the transition to a low-carbon economy. Taken together, these historic federal actions are allocating hundreds of billions of dollars over the next five to ten years, driving an economic restructuring of monumental proportions.

The generation, distribution and deployment of renewable energy is happening at scale and being applied to sectors across the entire economy including transportation, buildings, industry, agriculture, and waste management. At its core, this is an industrial transition necessitating manufacturing in the distribution phase (e.g. transmission equipment and technology) and in end-use sectors (e.g. EV vehicles, batteries, and charging, building components, farming technology and equipment, and consumer energy products).

Across the board, vast supply chains of global and domestic firms — large, medium, and small — are being constructed and cemented. However, many smaller firms are ill-equipped to master this transition as they lack the market intelligence, capital, contracts, and/or capacity to adjust accordingly.

This newsletter offers one path forward: a Green Business Initiative that cities and metros can use to grow the local share of businesses in the climate transition. As described below, the Initiative would prioritize and deconstruct supply chains in emerging green sectors and then work to identify and support locally based small enterprises that can benefit from new business opportunities.

The El Paso example

The Green Business Initiative would build on efforts in a few cities that are working to ensure that local firms prosper from the climate transition. As recently reported, El Paso, with support from the Nowak Lab at Drexel University and the Aspen Institute Latinos and Society Program, has launched a Supply El Paso effort to maximize the local impact of their sizable procurement economy. This Supply El Paso effort is focused intensely on the economic opportunities generated by the growing clean energy sector given that El Paso Electric is the second largest buyer of goods and services in the county, purchasing around $500 million annually. Across the country, utilities are major players in the energy transition, supporting the electrification of transportation, buildings, and industry.

Given the breath of the energy transition, the key to maximizing local business opportunities is to focus on the specific rather than the general. In El Paso, we used a multi-part process to identify areas of growth opportunity emerging from the energy transition.

1. Select a priority green supply chain

In El Paso, the regional deployment of Electric Vehicle (“EV”) charging infrastructure was selected as a priority supply chain for several reasons. In the first instance, the demand for installing and maintaining EV chargers is rising, as it is a key asset in promoting EV adoption. The 2021 Infrastructure Investment and Jobs Act funded $7.5 billion to support the buildout of a national public EV charging network, particularly along interstate highways. Meanwhile, numerous state and municipal governments are either investing directly in or subsidizing EV charging infrastructure development within their jurisdictions, and utilities, too, are moving into the EV charging space. Private investments in the sector are also registering historic levels. PwC estimates that the number of charge points in the United States is poised to grow from about 4 million today to an estimated 35 million in 2030, with the EV supply equipment market potentially growing from $7 billion today to $100 billion by 2040. Such a transformation of the economy could create significant growth potential for a specific group of green supply chains and, within their market, for smaller, regional firms.

Another reason for selecting EV charging infrastructure is that the nature of the work (i.e., construction activities are a critical part of the supply chain) aligns well with the strengths of local businesses in El Paso given metropolitan demographics. According to the Annual Business Survey, 9% of firms in the construction sector nationwide are Latino-owned, versus an average participation of 6% across all sectors. In some regions, this participation is even higher. In Texas, for example, Latino-owned firms are present in the construction landscape at a rate more than double the national average. This moment represents more than a shift towards renewable energy; it’s an opportunity for these firms to redefine the construction industry’s future. By aligning policy and industry support to amplify this existing capacity, the transition can serve as a catalyst for growth, not just in environmental sustainability, but in fostering wealth building for the Latino population within the construction sector and beyond.

The final reason for selecting EV charging infrastructure is that public funding for this activity is beginning to flow at scale. In 2022, Sun Metro, the public transportation provider, was awarded an $8.8 million federal grant (that was matched by a city government contribution of $2.2 million) to purchase EVs and install EV charging stations. Earlier this year, the city was also awarded $15.0 million from the USDOT FHWA’s Charging and Fueling Infrastructure grant, with an additional $3.8 million from El Paso Electric and El Paso County, to design and install a total of 74 EV charging ports. Adding to this efforts, Fort Bliss, the nation’s third-largest military base by total acres and sixth largest by value, is a key priority for meeting the ambitious decarbonization goals set by the Army Climate Strategy, including the fielding of purpose-built hybrid-drive tactical vehicles by 2035 and fully electric tactical vehicles by 2050, as well as developing the charging capability to meet the needs of fully electric tactical vehicles by 2050

2. Deconstruct the priority green supply chain

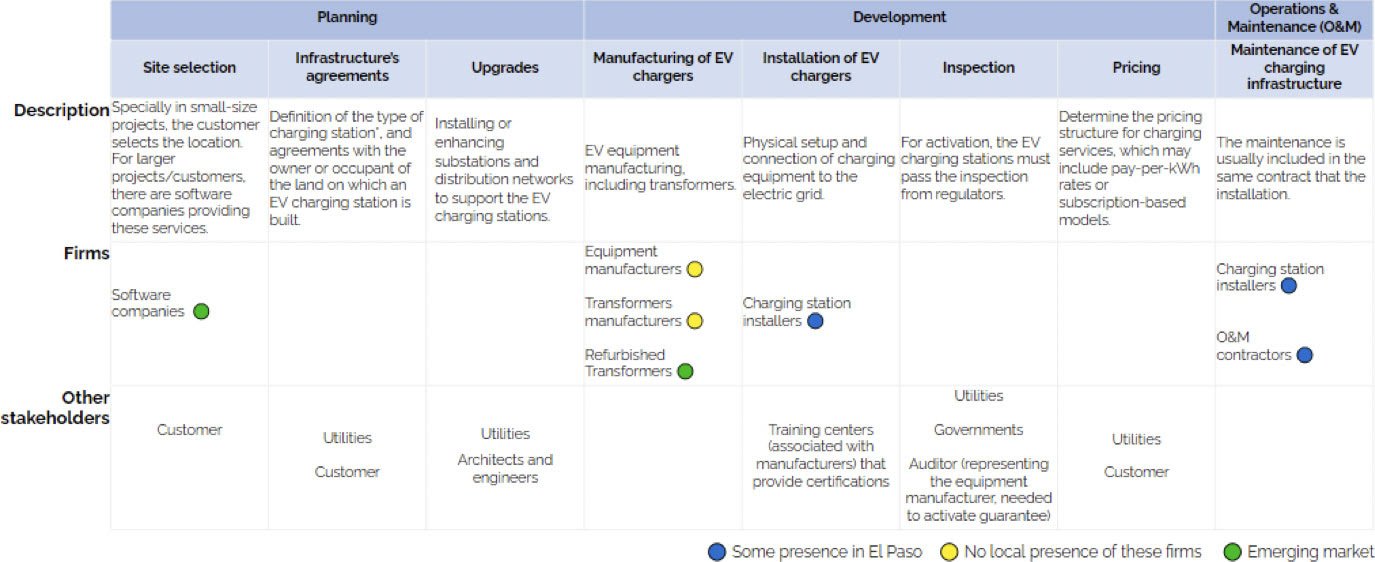

Against this backdrop, the Nowak Lab team worked closely with El Paso Electric and the City of El Paso to deconstruct the supply chain undergirding EV charging infrastructure and identify local firms that could, with the right capacity and capabilities, undertake certain economic activities. As Table 1 shows, the EV charging infrastructure supply chain in El Paso involves several stages, firms, and stakeholders, with a mix of local and national players operating from the initial planning to the maintenance of the network.

Table 1: Deep dive into the stages, firms and stakeholders in the EV charging infrastructure supply chain

Note: This diagram is illustrative, and it isn’t intended to be exhaustive, but rather to represent those parts of the supply chain with potential implications for the local economy. Source: Own elaboration for Supply El Paso (2023).

The deconstruction of green supply chains into discrete stages is key to assessing local business opportunities. As Table 1 illustrates, EV charging infrastructure involves three distinct sets of activities:

Planning: From site selection to the development of infrastructure agreements with landowners and upgrades to substations, this phase demands strong involvement from a utility or a private company, and, in some cases, the customer. For large, nationwide projects, a group of software companies are breaking into this market, providing georeferencing services to improve site selection and the management of the charger network.

Development: This stage includes the manufacturing of chargers (which has its own supply chain) as well as their installation, inspection, and pricing. While there are only a couple of major US companies manufacturing equipment, charging station installers, particularly for regional and local projects, are distributed nationwide.

Operations & Maintenance (O&M): Firms performing network maintenance and charging station upkeep are in many cases the same firms that perform the installation. While this service typically needs to be performed onsite, some nationwide companies, or even international ones, are deploying networks of electricians that move around the country. As we mentioned above, the EV infrastructure market is projected to grow to ~$100B by 2040. Charge point operators will generate most of the revenue in this market[1].

3. Assess the region’s positioning across the nodes of the supply chain

Once we identified the stages and stakeholders involved in the EV charging infrastructure supply chain, we assessed El Paso’s positioning to seize opportunities from the energy transition across three dimensions: industry base, talent, and regulatory environment. We started by exploring the characteristics of the companies involved in each stage, assessing the existing local industry base and potential opportunities for development[2]. We then identified the key occupations related to each stage and their local presence in El Paso. For those occupations requiring a degree, we mapped the pipeline of graduates from universities located in the region. Finally, for each stage and activity of the EV charging supply chain, we identified the rules and regulations with which businesses need to comply. We also interviewed both buyers and firms in the sector to capture their perspectives.

Our analysis shows that there may be opportunities for El Paso’s businesses in the construction, installation, and maintenance of EV charging stations, yet their possibilities are constrained. Strengthening the regional talent pipeline emerged as a key priority, since businesses in this industry often rely on certified electricians and electrical engineers. Helping EV charger installers in the region navigate requirements and regulations was also noted as a need to untap the opportunities for the regional industry base. These installers need to be manufacturer-certified and follow state and local regulations. Of the few installers in the El Paso region, only one is certified by the manufacturer, limiting the readiness of the local businesses to serve the growing demand. There may also be opportunities for regional firms to tap into emerging markets associated with the EV charging infrastructure supply chain, such as technology services that aid the transition and the market of refurbished transformers.

4. Moving from concept to reality

Supply El Paso calls for a new collaboration — a Procurement Marketplace Council — led by the city and county government that would involve key procurement agencies as well as critical parts of the business ecosystem like chambers of commerce and business leadership groups. The goal, generally, is to bridge the gaps between procurement opportunities, support organizations and regional vendors and foster the creation of a robust marketplace for local firms. Given the oversized procurement power of the energy sector, Supply El Paso recommended that one critical priority be around green supply chains.

A Green Business Initiative

We believe that our work in El Paso has created a replicable process that enables local enterprises to take full advantage of the energy transition. We believe that this work can inform the creation of Green Business Initiatives in cities and metropolitan areas across the country.

Informed by El Paso, a Green Business Initiative would have a series of sequenced steps and activities.

The starting point is to form a partnership of local governments, utilities, business chambers, universities, support organizations and capital providers. These entities already are part of a broader ecosystem — sometimes formal, many times informal — that help small businesses seize market opportunities.

Once formed, the partnership can prioritize a few clean energy sectors that best align with the distinctive assets of the region and are most likely to have a sizable impact on job creation and the maximization of federal funding. In El Paso, the sector selected was the planning, installation and operation and maintenance of a network of EV charging stations. As described above, that made sense given the substantial presence of Latino-owned firms in the construction sector. Other metropolitan areas may have traction in manufacturing or other energy sectors that warrant a priority focus.

For each prioritized sector, the partners can then deconstruct the emerging supply chains of firms that are likely to deliver different aspects of projects. Deconstructing green supply chains allows for the proper identification of niche markets, untapped potential, and strategic entry points for local businesses. As in El Paso, these supply chains would represent distinctive stages including design/planning, pre-development, capital provision, execution, and operations/maintenance. The breakdown of project stages will enable local and regional actors to discern which activities will be delivered by local and regional enterprises and which activities will be delivered by national or even global firms.

With this breakdown, the partners can then develop an inventory of local and regional businesses that are able to provide different parts of the sector “supply chain.” Depending on the sectors, this inventory could involve an eclectic network of locally based firms involved in design, finance, and delivery including energy project developers, financial institutions, environmental remediation firms, building and construction firms, architectural and design firms, manufacturing and technology firms, and operation and maintenance firms.

With such an inventory, the partners can then engage with promising local businesses, exposing them to opportunities that are emerging from the climate transition and offering a suite of supports (e.g., customized business plans, access to potential customers and cutting-edge technologies, specialized workforce training, joint ventures with prime companies, quality capital, assistance with manufacturing certifications) designed to accelerate entry into the marketplace. This is where the true “firepower” of the initiative would lie — in providing customized support to businesses so that they can grow and scale.

As the energy transition unfolds, the question of whether it will offer opportunities for a vast network of small businesses is still unanswered. Local experimentation with Green Business Initiatives, like the innovations now occurring around housing affordability and so many other challenges left unattended by federal and state governments, will help answer this question in the affirmative.

Bruce Katz is the Founding Director of the Nowak Metro Finance Lab at Drexel University. Victoria Orozco is the Founder of the Punto Lab.

[1] According to PwC, once EV adoption rates approach mainstream, integrated charge point operators have the potential to greatly improve their top and bottom lines from bundled offerings including financing, operation, maintenance and utility charging.

[2] We did this exercise through qualitative research (including interviews with key stakeholders) and an extensive analysis of county-level data at 6-digit NAICS codes (we identified all the NAICS codes connected to different stages and activities of the supply chain, and analyzed firm presence, employment, and Location Quotients).