Creating the Investment Prospectus for Your City

Section 5: Your City by the Assets

Each city should provide specific information on assets that show market momentum or potential around sub-geographies (e.g., downtowns), leading sectors or amenities, location of anchor institutions, entrepreneurial activity and workforce. This section should showcase your competitive advantage by making the case that your city possesses assets which investors can build upon through their own projects. Highlighting differentiation is key—what assets make your city special? Don’t shy away from background strengths in infrastructure, utilities and logistics. Louisville’s prospectus is displayed below as an example—its assets might spur thinking about your own, but no need to imitate all aspects of how they distinguish themselves.

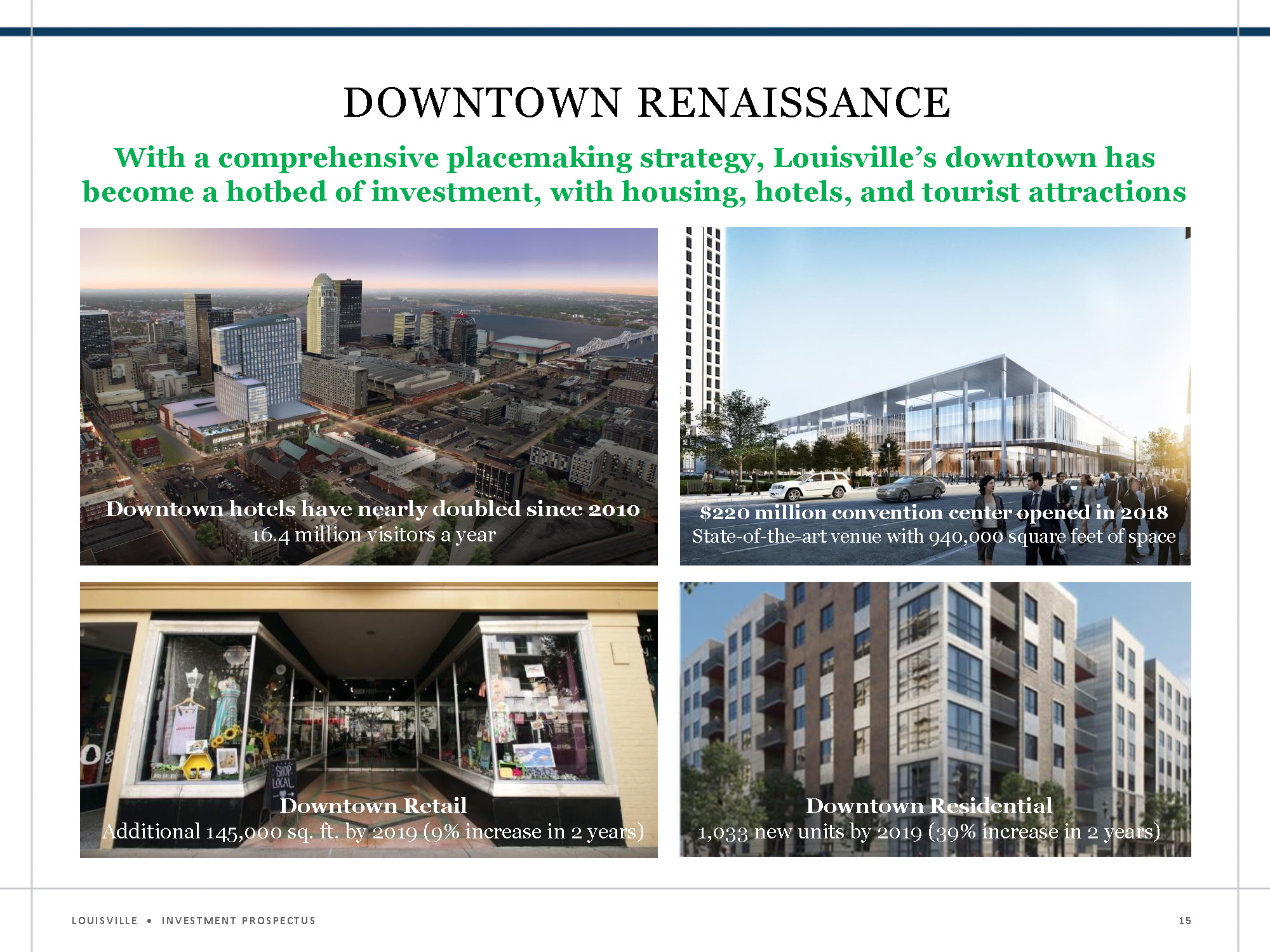

Louisville’s asset #1 highlights their downtown renaissance

Many cities maintain data on downtown dynamics via local government, business improvement districts or business chambers. Are there strengths in your CBD or inner-core neighborhoods which investors should be aware of? Think about the geographic typologies within your city with strengths that should be highlighted for investors.

Downtown Renaissance

With a comprehensive placemaking strategy, Louisville's downtown has become a hotbed of investment, with housing, hotels and tourist attractions

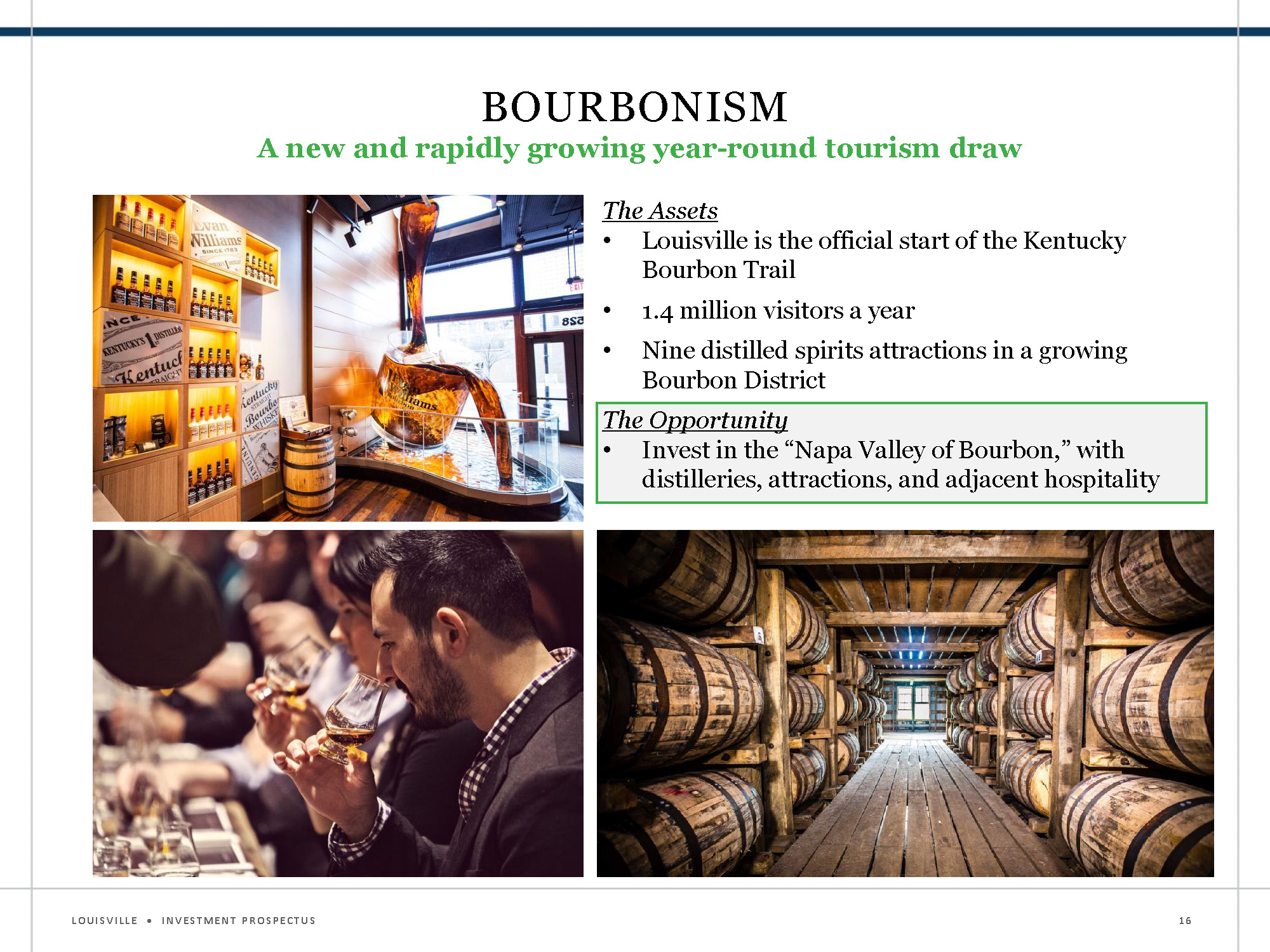

Louisville's asset #2 highlights the bourbon industry as a unique tourism draw

Cities should highlight a sector or even a company/university that can catalyze growth and Opportunity Zone investment. Even if an asset seems obvious, remember that some audiences will need to understand the basics about your community, so don’t assume investors already know.

Bourbonism

A new and rapidly growing year-round tourism draw

The Assets

- Louisville is the official start of the Kentucky Bourbon Trail

- 1.4 million visitors a year

- Nine distilled spirits attractions in a growing Bourbon District

The Opportunity

- Invest in the "Napa Valley of Bourbon," with distrilleries, attractions and adjacent hospitality

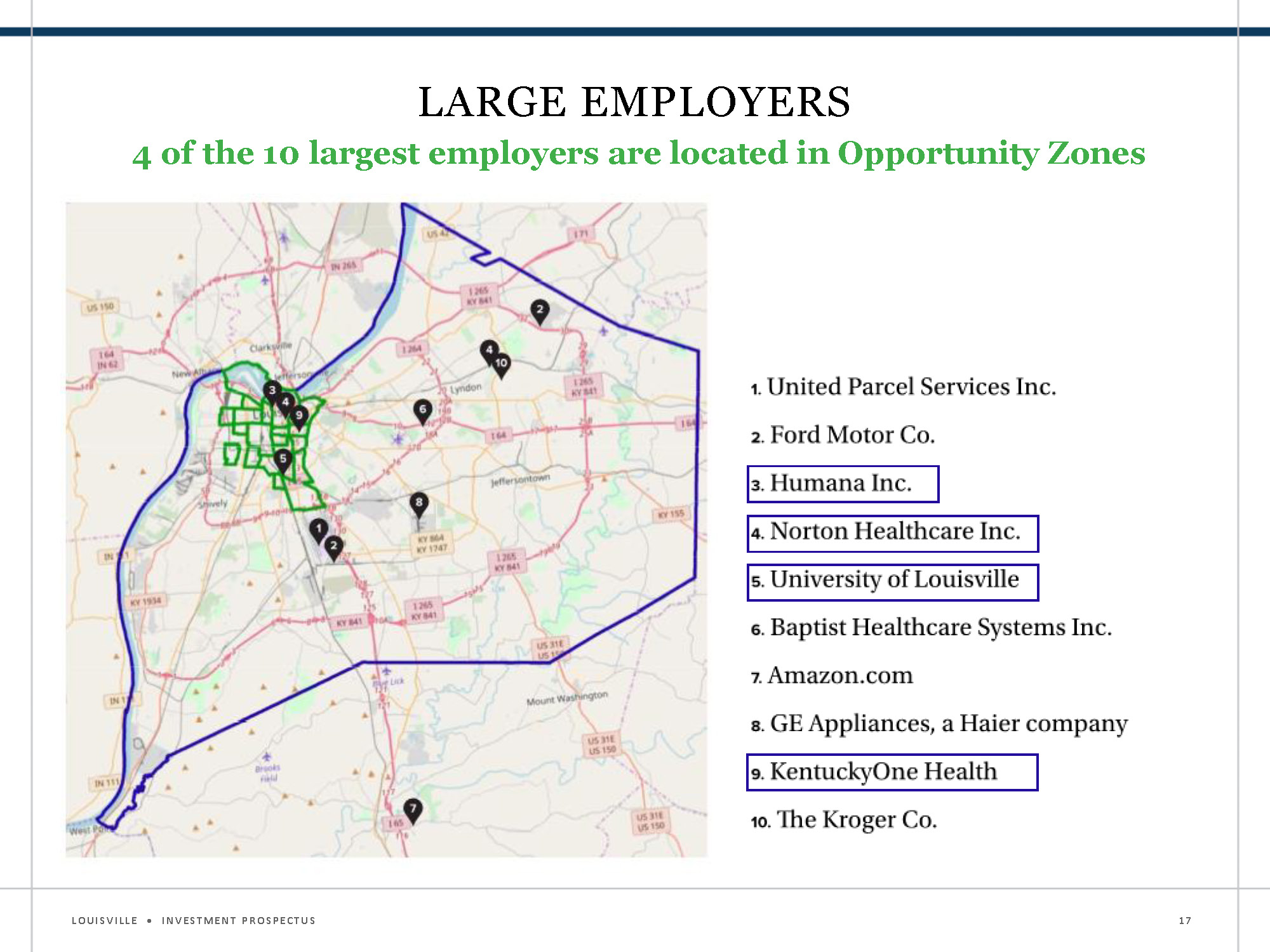

Louisville’s asset #3 focused on the presence of large employers in or near their opportunity zone areas

The spatial overlap of anchor institutions and Opportunity Zones identifies potential stakeholders for a purposeful city strategy and potential investors/developers in Opportunity Zone transactions. This is a place where you can highlight spatial connections which might not be apparent to investors.

Possible data sources: City/county department of revenue, State labor statistics

Large Employers

4 of the 10 largest employers are located in Opportunity Zones

- United Parcel Services Inc.

- Ford Motor Co.

- Humana Inc.

- Norton Healthcare Inc.

- University of Louisville

- Baptist Healthcare Systems Inc.

- Amazon.com

- GE Appliances, a Haier company

- KentuckyOne Health

- The Kroger Co.

Louisville’s asset #4 focused on the growing start-up activity in the city

Information on areas of market momentum helps unveil the health and vitality of the city’s innovation ecosystem. Additional data might be shown around the state of entrepreneurship in general and neighborhood businesses in particular. Investors will look for connections to existing geographic and place assets—is an innovation district emerging or naturally occurring?

Data source: PitchBook

Growing Start-up Investment

- From 2010-2013 to 2014-2017 a 98% increase in venture capital deals

- $255 million in venture capital investment since 2014

- from 2010-2013 to 2014-2017 a 10% increase in small business association loans

- $172 million in small business association loans since 2014

- Louisville has 31 active venture capital firms

- Access Ventures

- Blue Equity

- BlueSky Network

- Cardinal Venture Fund

- Enterprise Angels Fund

- Lunsford Capital

- Patoka Capital

- Radicle Capital

- Sequel Fund

- Weller Equity

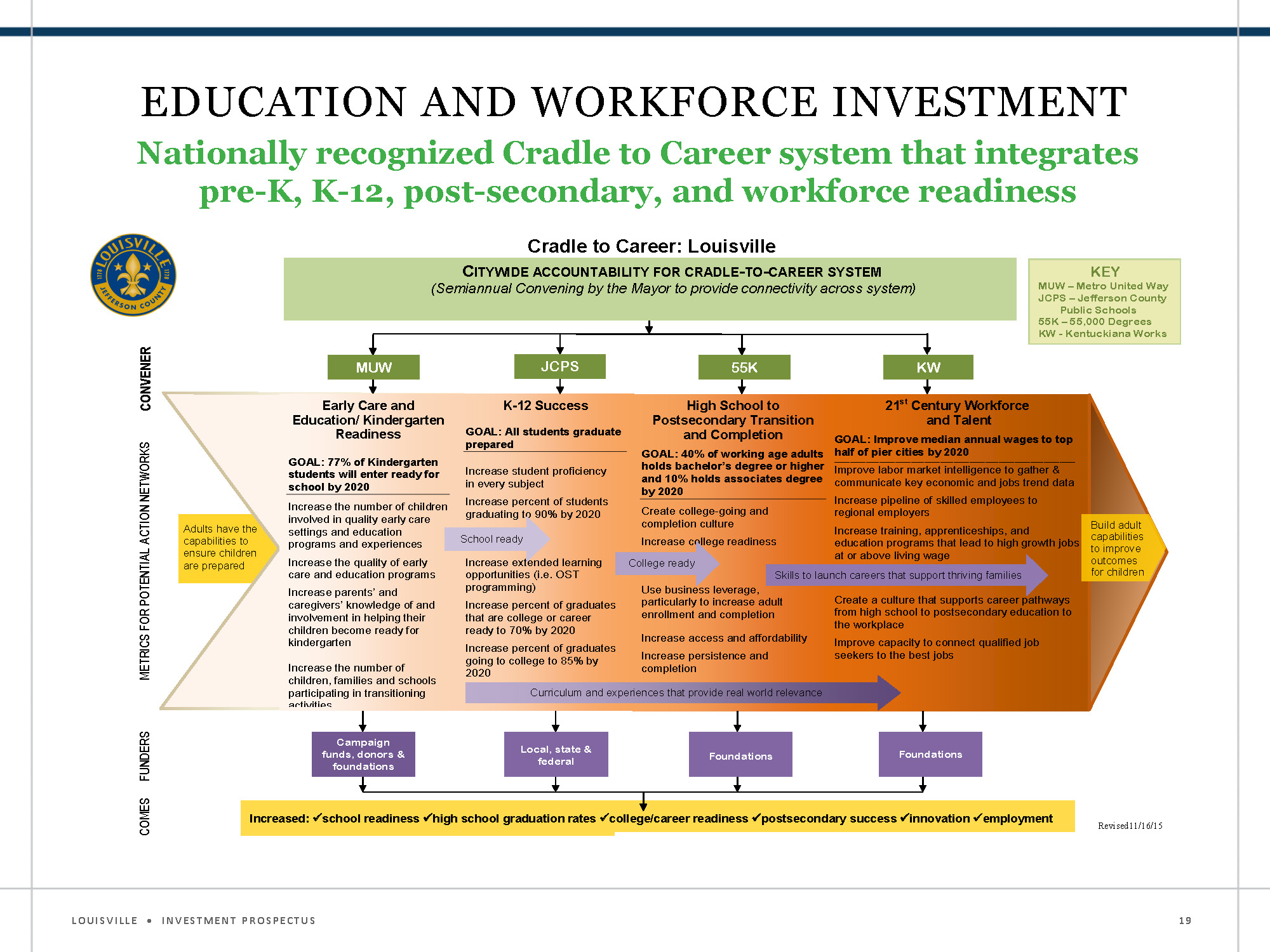

Louisville’s asset #5 focused on the cities nationally recognized cradle to career investment

Upgrading the education and skills of children and young adults aligns well with the 5-10 year hold period for Opportunity Funds and could be a major component of a city’s inclusive growth strategy. How is your city building human capital and ladders of opportunity to support inclusive growth over the life of the Opportunity Zone investment?