New Localism 2021: Organizing for Uncertainty

Below is the Nowak Metro Finance Lab Newsletter shared biweekly by Bruce Katz.

Sign up to receive these updates.

November 12, 2020

(co-authored with Colin Higgins)

As our nation turns its weary and anxious eyes away from the election, we are thinking hard about what comes next. We are entering into one of the worst phases of the COVID pandemic with massive uncertainty about what type of stimulus will come and when.

Our message here is a simple one: local economic stakeholders cannot afford to wait to proceed until the federal fog of uncertainty lifts. They must start organizing now.

As we wrote in early April, local economies did not have the luxury of waiting for federal action on small business relief. Today’s situation is similar, but different in one key respect: rather than just emergency relief, what’s at stake is a recovery that will shape the next decade (and longer) for local economies. In March, local stakeholders across the country set up local small business relief funds before the federal government could act. Today, action is needed on a vaster scale which organizes public, private, and philanthropic stakeholders locally to provide versatile channels for directing resources for a recovery—regardless of where the federal government settles.

Below we provide a review of the federal post-election uncertainty and the beginning stages of a local roadmap for how to organize through this uncertainty and maximize the impact of the recovery. We believe that small business will be one of the earliest, most emblematic, and most important, sources of recovery capital. It is also a domain where local stakeholders have a better view of the situation and where many of the actions are valuable even in the absence of federal funds. Federal funds are not the only game in town either: private funds can be utilized here too. Indeed, we are already seeing philanthropic capital from large companies like JP Morgan Chase, Bank of America, Verizon, and Netflix to address the crisis facing Black- and Latino-owned businesses. As a result, small business should be a top metro recovery priority that serves as a model for subsequent efforts. (Note: We are working with Accelerator for America and Mastercard’s Center for Inclusive Growth to create a template for recovery playbooks; more to come by January).

New localism in a fog of federal uncertainty

Assuming office in January, the incoming Biden-Harris Administration will be handed “a hot American mess” as Axios puts it. They will be tasked with solving the four intersecting crises of public health, race, the economy, and climate change that our deeply polarized country is currently wrestling with. On top of this, it’s not yet clear who will control the senate. This will be decided by two runoff elections in Georgia on January 5th. If Democrats sweep, we are looking at a likely large stimulus driven by a push-and-pull between the Left and Center of the Democratic Party; if Republicans hold the majority, we’re looking at divided government and questions about whether the federal response will be adequate to the depth of the downturn.

On top of this, it is uncertain what the lame-duck session before inauguration holds. The Trump Administration is preoccupied with its quixotic pursuit of overturning election returns and has brought many GOP leaders into the fray. It has delegated stimulus efforts to Majority Leader McConnell, who has expressed interest in passing a bill before January. Speaker Pelosi has also expressed a desire for additional relief, but it’s unclear if they’ll be able to reach a deal. The Biden-Harris Transition Team is also starting conversations this week with the Democratic leadership to advance their priorities in a coming stimulus.

In short, the Hill is steeped in a fog of uncertainty that will clear in one of four ways. Yet it’s not yet obvious which outcome is the most likely:

(1) a lame duck stimulus in December followed by a small countercyclical package in February;

(2) no lame duck stimulus and a small countercyclical package in February;

(3) no lame duck stimulus and a large countercyclical package in February; or

(4) a lame duck stimulus in December followed by a large countercyclical package in February.

In short: It is unclear when the federal cavalry is coming and what size it will be when it arrives. Amidst this federal uncertainty, local stakeholders must seize the reins of their economic destiny.

In the still-possible case of a divided government, local organization is not merely an option, it is a necessity. Even in the most ambitious of federal recovery packages, we would advise local leaders organize to maximize the impact of a recovery. The fundamental lesson we learned from the 2009 Recovery Act is that the places with organized local leaders were able to direct locally transformational federal investments: Chattanooga, TN, for example did just this and leapt ahead in high speed internet and clean electricity.

Local leaders should organize around three goals to ensure a transformative recovery: (1) harnessing the full energies of the local; (2) being flexible to enable alignment between federal and local priorities; and (3) building capacity locally. To actualize these goals, they should follow the roadmap below.

What should local stakeholders do? A local roadmap to seize this moment

The inclusive development of metro economies is an inherently complex, multi-disciplinary, cross sector challenge. This is especially true in a recession and even more-so during a pandemic. Ongoing attempts to advance the economic prospects of places can originate from one-or-all of many institutions: anchor corporations, business leadership groups, universities and hospitals, city governments, city or state economic development entities, metropolitan planning organizations, quasi-public authorities, community organizations, and more. Adding to the complexity, well-intentioned actors must navigate federal, state, county, and local politics and programs.

To date, unifying entities that bring the entirety of a city’s capabilities to bear for its economic development have been few and far between. Recent years have presented a glimpse of what cities are capable of when they bring key stakeholders together to maximize the impact of an exogenous opportunity. In 2017, Amazon set off a historic frenzy by announcing their intention to open a new headquarters, dubbed HQ2. Then, in December of the same year, the Tax Cuts and Jobs Act created the Opportunity Zones incentive, which encouraged investment in distressed neighborhoods. While not without controversy, these two occurrences spurred cities to organize and communicate their strengths, and in so-doing brought about cross-sector collaboration through the development of creative pitches and investment prospectuses.

Local stakeholders would be wise to view the coming relief and recovery package is the most important public investment in metro economies in this decade. They should take the lessons of the previous three years to organize themselves around a plan to maximize the impact of the COVID-19 relief and recovery spending. This is an “HQ2 moment” regardless of the size of the federal stimulus. At stake is nothing less than the strength of local economies for the next decade or more.

We recommend that coalitions of local stakeholders take the following five actions to seize the moment

First: Immediately Stand Up A Metro Recovery Task Force

In order to establish a clear set of plans and priorities and to maximize the speed and effectiveness of the post-COVID recovery, we recommend that every major metro immediately stand up an executive-level task force with leaders from the public, private, and civic sectors that has a rapid-response “war room” focused on the recovery. Many cities, such as St. Louis, have done this for public health. This organization can serve as a model for the economic recovery.

This task force must complete four deliverables, outlined below, by no-later than late January 2021 when the initial federal relief package is expected to be passed. At a minimum a metro task force should designate local leaders to guide planning and gather intelligence around these four components:

1. Setting Local Priorities for Key Areas of Economic Recovery: Cities need to declare their distinctive priorities in each of 4 core economic recovery categories: innovation, infrastructure, small business, and workforce. These priorities should be shaped by an evidence-driven view of local challenges and opportunities.

2. Understand Federal Investments: Cities need to understand federal priorities and agency spend categories and position metro priorities appropriately. We elaborate below.

3. Build Readiness Teams: Cities should focus on building capacity across local institutions and practitioners to ensure that federal funds can be delivered in an efficacious, fair, rapid manner.

4. Engage communities: Cities and local leaders should focus on building channels to communicate to local residents to ensure transparency and engagement with the process throughout.

How it’s happening for small business:

As we recently wrote in our Big Ideas for Small Business report, small businesses flourish with the support of institutions designed to maximize procurement demand, financing, counseling, market-making, business districts, and other services. Federal programs are a compliment to, rather than a substitute for, a strong local ecosystem of incubators, Community Development Financial Institutions (CDFIs), public development corporations, Chambers of Commerce and other organizations. Federal programs have the greatest impact when they work with local organizations that can help small businesses access federal resources and leverage federal dollars through additional public and private investment.

Not all regions of the country benefit from the same quantity or quality of these ecosystem-building institutions. Some metropolitan areas like Los Angeles and Philadelphia, for example, have a strong network of CDFIs, which has enabled them to design and deliver special initiatives that are tailored to particular communities or segments of the business community. But many other areas do not have this.

To best support small businesses, we recommend that local task forces and ecosystems take six actions we highlight in our Big Ideas for Small Businesses report—prioritizing community engagement throughout—including:

- Maintaining real-time information on the number, size and sector of small businesses in general and minority and women-owned business enterprise (MWBE) in particular;

- Routinely collecting data, set goals and publicly report progress on the procurement spend of large “anchor institutions” from minority- and women-owned businesses;

- Identifying, nurturing, mentoring, and supporting firms to develop intentional business strategies and gain access to the network of providers that offer the most up-to-date information on such practices as accounting, borrowing, leasing, legal, tax, hiring, technology, marketing and customer and supplier relationships;

- Providing access to high-quality, affordable, and responsible capital across a broad continuum that is aligned with the needs of small businesses at different stages of their lifecycles and in disparate sectors;

- Managing and marketing business districts and commercial corridors where many small businesses congregate and co-locate; and

- Fostering peer-to-peer networks among small-business owners and entrepreneurs to share resources and advice, serve as prospective buyers of other local businesses, and build collective action to inform and influence ecosystem strategies and initiatives.

Second: Clearly Outline Metro Plans and Priorities

By January 2021, the Task Force should know and position metro priorities around a key recovery narrative and actions in a short memo that will act as the ultimate guidance for local plans developed and federal asks that are made.

It’s likely that recovery spending will first move to small business recovery—following which it will move to a combination of infrastructure, innovation, and workforce/human capital. These spend categories are likely to be widely distributed across federal agencies, programs, and products. We recommend organizing for small business first and using that experience to shape subsequent metro plans and priorities in other spending categories.

The City Task Force should liaise with leaders and the community to develop a document that clearly articulates the highest local priorities and visions, while positioning them within likely countercyclical spend categories. Drafters should pay special attention to how these priorities respond to likely spend categories, agencies, and products. Crucially, organizing yourself around key recovery categories is not just about getting more federal resources, it is about using them to greater impact by leveraging them with private resources.

It is imperative that local coalitions organize to navigate the dizzying array of federal funds—loan products, tax incentives, competitive grants, block grants—and agencies. Recovery funding will be multi-sectoral and multi-dimensional. The best organized localities will be the best positioned, regardless of what happens in DC. Already some local coalitions in Chicago, Cleveland, Kansas City, Philadelphia, St. Louis and San Jose are orienting recovery plans around key priorities like innovation and small business.

How it’s happening for small business:

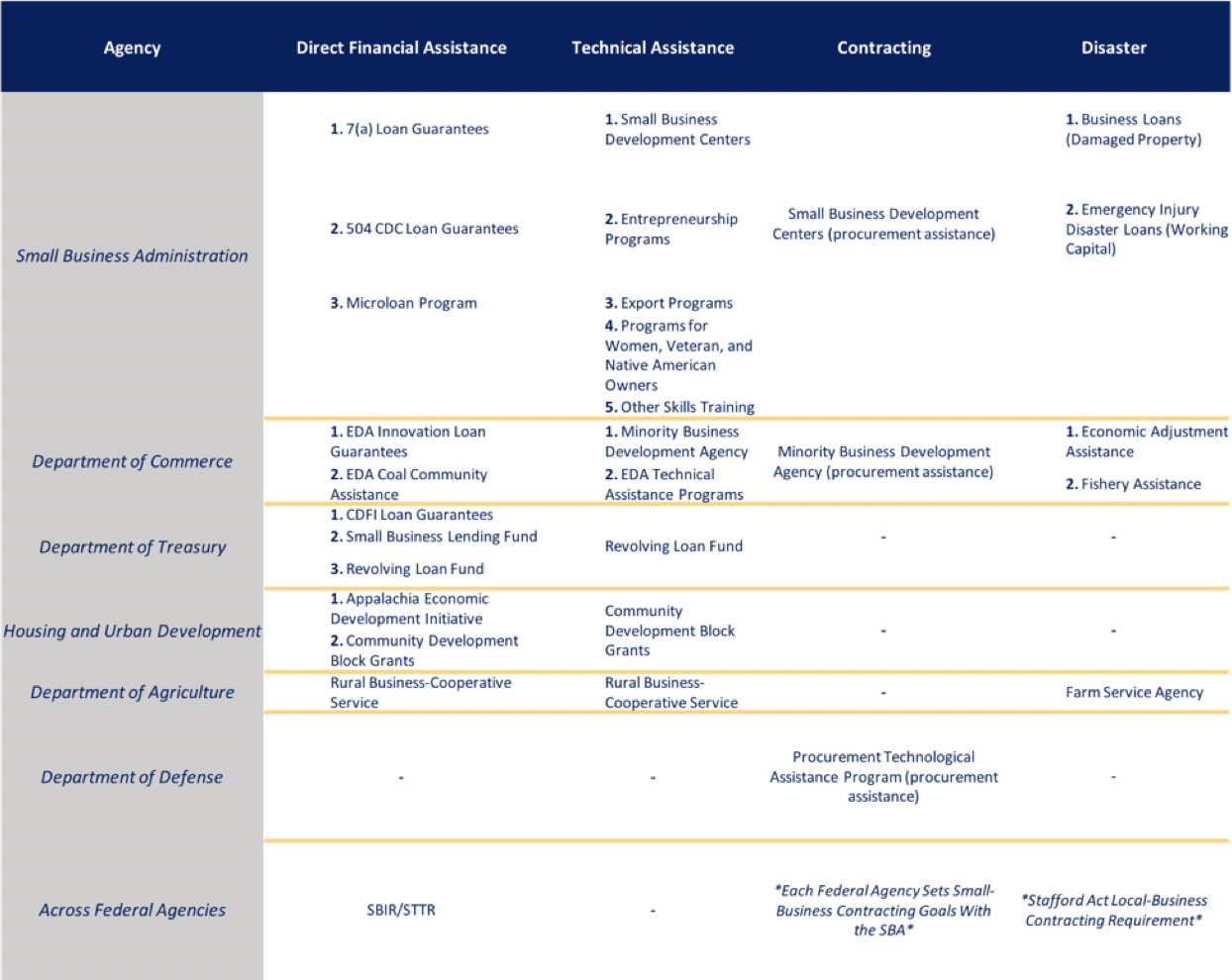

The Federal landscape of small business support is emblematic of this matrix. Prior to COVID-19 it was composed by 31 separate funding streams, distributed across four product-types and six federal agencies (with additional cross-agency initiatives). The pandemic response has created a second overlay of new products. It’s likely that small business relief funding will come through modest increases of funding to these existing channels alongside COVID-specific products like a revised Paycheck Protection Program. We recommend that local task forces have clear plans to navigate this array of possibilities along with guidance for metro stakeholders. In the case of small business, this involves building a business ecosystem that can harness and leverage federal resources and engage with communities excluded from previous rounds of support—and this pattern repeats across all major recovery spending types.

Figure 1: As we outline in our recent report “Big Ideas for Small Business”, Pre-COVID small business funding comes in a wide matrix of product types. This matrix of “old” funding sources will likely be layered with new products targeted to the recovery. This pattern is repeated across different relief and recovery categories. Having a Task Force with a clear idea of what funding source is tied to what project will enable metro economies to maximize the impact of already existing federal funding sources.

Third: Designate Your Local-to-Federal Liaison

By January 2021, the Task Force should designate a federal liaison as the go-between to Washington. Competition is likely to be intense for limited federal resources. This is especially true if we are in a situation of divided government. Having a plan to navigate the landscape is the first step, but metros that have a designated federal liaison will benefit immensely. This liaison should understand the ins-and-outs of different federal agencies as well an understanding of metro priorities, and a good sense of the different financing products that the federal government uses. They should be the key conduit for locals to push for flexibility in federal-to-local products as well as to highlight the way local priorities fit within the Biden-Harris Administration’s goals.

Fourth: Establish a local coordinating intermediary for fair and effective fund deployment

By January 2021, the Task Force should establish a local funding coordination entity to maximize local use of federal relief and recovery dollars. In the past, one of the biggest issues for metro economies trying to use relief and recovery bills is that countercyclical funds have been obligated but not deployed. This was true of weatherization and infrastructure money in the 2009 recovery act, and it is currently true of money in the CARES Coronavirus Relief Fund. In general, it is also true that the federal funds that are most efficiently deployed are those which run through existing federal funding channels. The lesson here is that funds will be deployed effectively if there is clear guidance and local knowledge and capacity.

A key way to build this local knowledge and capacity is to establish or support a local intermediary through the Task Force that can be a “clearinghouse” to understand what federal funds can be used for what local projects and can ensure equity across neighborhoods in the process. It is difficult to establish one of these from scratch. We recommend establishing a local intermediary that coordinates existing efforts that are already underway to both avoid reinventing the wheel and to present a locally “unified front” when effectively deploying money.

How it’s happening for small business:

We have been working closely with a group of cross-sector local leaders in Cincinnati to establish the Cincinnati Regeneration Alliance (modeled off our call for Main Street Regenerators). The Alliance, once established, will represent a coordinating council made up of representatives from key community and business organizations to ensure that the small business recovery is geographically fair and that the city is utilizing its Coronavirus Relief Fund money effectively. The Alliance would have seven core functions that will be carried out over its 36 month lifespan: (1) Leveraging Anchor Procurement; (2) supporting Black-owned business; (3) Maximizing Real Estate usage; (4) Increasing access to capital; (5) driving quality place making; (6) diminishing the impact of the parasitic economy; and (7) building wealth.

Fifth: Establish a local fund leveraging intermediary

By January 2021, establish an intermediary to leverage local sources of capital with federal spending. Last, but definitely not least, given the probability of a skinny stimulus, local governments should make every effort to leverage federal public money with private capital. This will not happen by itself. It will take dedicated work and an intermediary to coordinate efforts, engage the community, and attract capital. As was true for economic development initiatives of the last few years, local intermediaries will be essential to getting the job done here. The places that have more capable local intermediaries to blend public and private money will be able to have a larger impact in their recovery. On top of this, they will be more apt to get greater public and private investment.

We recommend that the Task Force takes steps to establish a local fund-leveraging intermediary as soon as possible. This can be a part of, or separate from, the coordinating intermediary described above.

How it’s happening for small business:

The Detroit Strategic Neighborhood Fund, is a funding source that draws from bank and philanthropic contributions and public subsidies to improve Detroit neighborhoods. It is managed by a CDFI, Invest Detroit, which also takes the lead on fundraising. In 2016, the fund raised $30-42 million to target 3 neighborhoods. In each of the three neighborhoods, it activated an eight to twelve block Microdistrict to support gap-financing for development projects. So far, funding for the three neighborhoods has been used for tax credits toward affordable housing in the Islandview-Greater Villages area and kickstarting the Fitzgerald neighborhood project, which includes renovating several homes owned by the Detroit Land Bank Authority, and crafting a new greenway throughout the neighborhood. In 2018, it raised $130 million for 7 additional neighborhoods. Funders include a wide range of public and philanthropic funders (notably the CDFI Fund and JP Morgan Chase). Models like the Strategic Neighborhood Fund will be vital to make the most of federal stimulus.

The path ahead

In our estimation, the recovery from COVID-19 amidst the country’s current division—and a potentially divided government—is going to make it one of the most difficult and fraught recoveries since the Great Depression. Getting this country back on track will take everything we have from the federal and government, state governments and local networks. Importantly, it will require local networks organizing themselves right now to effectively distribute stimulus money. Even in the event of a skinny stimulus, this organization will pay dividends since the local infrastructure will serve as a key way for attracting and leveraging investments from private and philanthropic actors. There’s a lot of uncertainty on the hill right now, the one certainty is that it’s not merely an option for cities to organize, it is a necessity.

Bruce Katz is the Founding Director of the Nowak Metro Finance Lab at Drexel University. Colin Higgins is a Senior Research Fellow at the Lindy Institute at Drexel University (which houses the Nowak Metro Finance Lab).