Determining Fund Classification

Research Accounting Services (RAS) is responsible for establishing new awards in the Banner ERP system once the Pre-to-RAS handoff has been made. This can occur when an advance fund is requested via the Advance Cost Center Form [PDF] or when a notice of award is received by Pre-Award from the sponsoring agency. Upon receipt of these notifications RAS must evaluate awards to determine their proper placement in the chart of account's fund hierarchy.

Recent accounting guidance requires that the University and the Academy of Natural Sciences transition to Accounting Standards Update 2018-08 - Not-For-Profit Entities (Topic 958): Clarifying the Scope and the Accounting Guidance for Contributions Received and Contributions Made. his accounting standard, which we will refer to as ASC 958, serves to clarify and assist entities in (1) evaluating whether transactions should be accounted for as contributions (nonreciprocal transactions) within the scope of Sub-Topic 958-605 - Not-for-Profit Entities-Revenue Recognition, or as exchange (reciprocal) transactions subject to guidance in Topic 606-Revenue from Contracts with Customers, and (2) determining whether a contribution is conditional. This last statement will not seem important to researchers and department administrators, but for those that handle the University and the Academy's financial reporting, it is of significant importance. The University community will not really notice the accounting decisions being made outside of the assignment of fund numbers starting with different numbers.

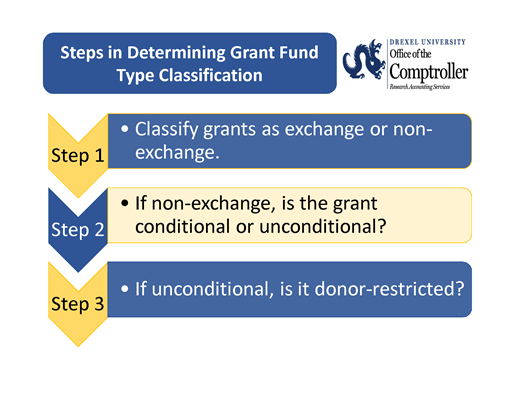

Steps in Determining Grant Fund Type Classification

Steps in Determining Grant Fund Type Classification

- Step 1: Classify grants as exchange or non-exchange.

- Step 2: If non-exchange, is the grant conditional or unconditional?

- Step 3: If unconditional, is it donor-restricted?

We hope that this will help you to better understand the fund number your award has been assigned, or was assigned prior to the implementation of the new guidance in FY2019. The image to the left provides the Financial Accounting Standards Board's (FASB) decision-making framework as a flowchart to assist in distinguishing whether grants are exchange or non-exchange transactions. If they are non-exchange transactions, they then have to be determined to be conditional or unconditional. Please also review the Office of the Comptroller's flow chart for information on accounting for grants and contributions under ASC 958.