Voices from the Field: How Financial Innovation Can Enable Inclusive Opportunity Zones

By Lori Bamberger and Bruce Katz

March 27, 2019

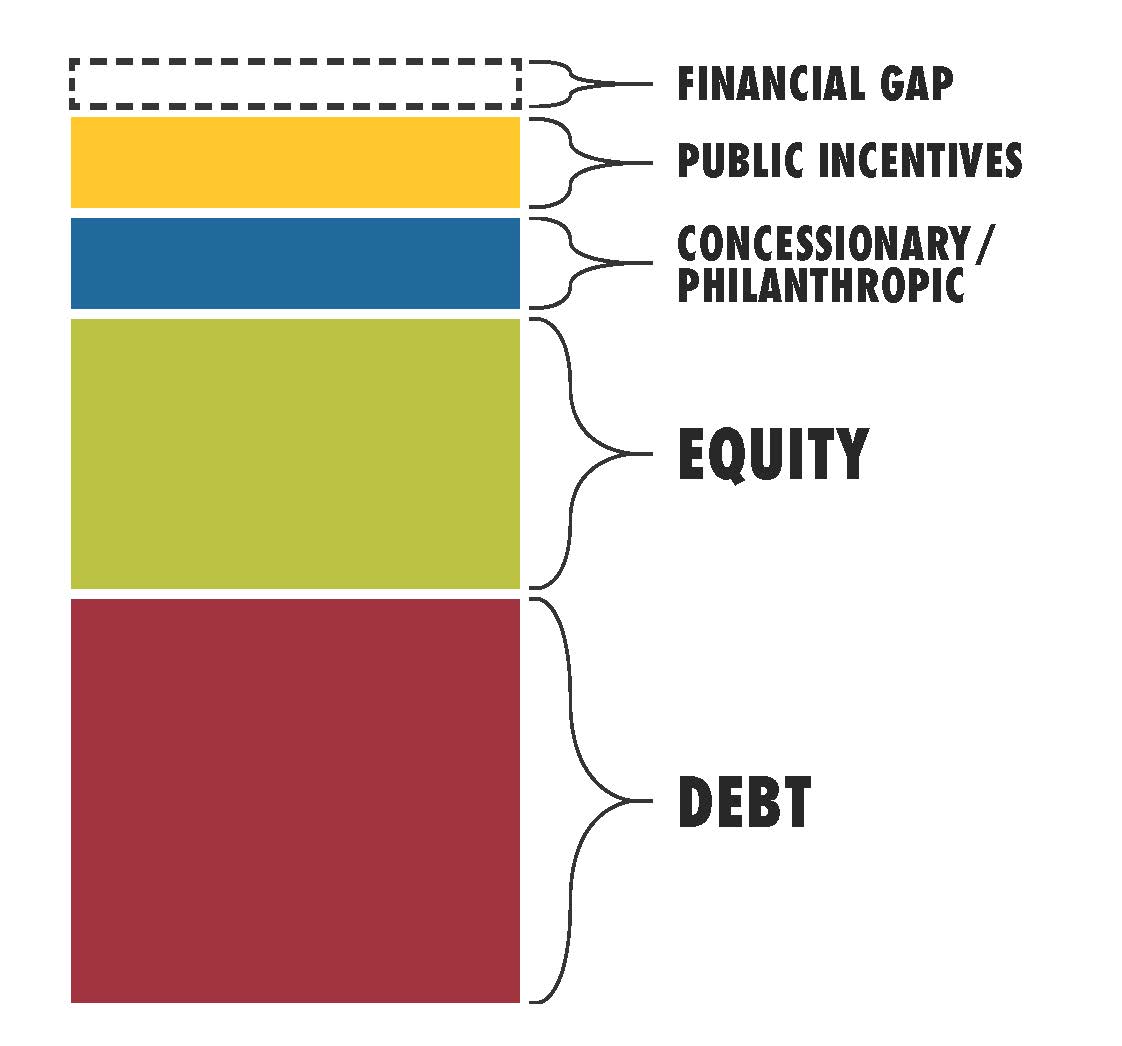

Example of Capital Stack used in urban development

Full Report: Voices from the Field [PDF]

The recent Opportunity Zone Investor Summit co-hosted by Accelerator for America ("A4A") and presented by the Mastercard Center for Inclusive Growth at Stanford University signals a perfect moment to provide an early report on our conversations with finance experts and on the ideas articulated by Investor Summit Panelists from all across the country. For the past several months, Lori Bamberger has been hosting conversations with a remarkable set of leaders in the fields of community development, private equity and impact capital, banks and community development financial institutions (CDFIs), tax, renewable energy, clean water, infrastructure, philanthropy and family offices, venture capital and social enterprise.

Over 400 more experts, including Mayors or delegations from 35 cities, attended the March 18, 2019 Investor Summit to share learnings and pitch projects to investors. We conducted these interviews and convened the Summit in hopes that we could use these experts’ collective wisdom to ascertain how to use the Opportunity Zone tax incentive to catalyze new financing for inclusive, job-creating, economic growth-propelling, clean and resilient, wealth-building change for the people and places that have suffered from decades of disinvestment.

As Jeremy Nowak immediately recognized, the evolution of Opportunity Zones is an unprecedented exercise in bottom-up rather than top-down market making. While the federal government will ultimately write the basic rules, the evolution of the Opportunity Zone tax incentive will also take place via market norms and policy and practice innovations that are invented in one city and then replicated or adapted in rapid fashion across multiple communities.

The conversation a year ago focused on the translation of what the incentive is—that it is not a federal "program," but a tax incentive—a 200-400 basis point boost in returns on a 10-year equity investment into a real estate project or new (or expanded) business venture located in one of 8,700+ census tracts designated as Opportunity Zones. Cities early on articulated their need for this new private investment, but only if the cost would not include displacement or gentrification. Investors early on focused on shovel ready deals in the right tracts with the right returns.

Now the conversation is maturing on both sides of the aisle. Both sides of the equation—cities and investors—are immersed in learning the language of communities and their development pipelines, on the one hand, and the vernacular of private equity, impact and venture capital, and family offices, and their operations and needs, on the other.

With tight timelines—deals have to be ready by at least 7 years before the 2026 deadline to take advantage full advantage of the OZ tax incentive—questions abound. What does the financing look like, how can we routinize it, what are the capital stack prototypes, and, perhaps most important, how can cities get in front of the planning to help steer investment to those developments and businesses that will create jobs, build inclusive growth, preserve housing opportunities, and promote resilience and clean energy? On the other side, how can we best introduce a new impact investor to the economic potential of these ailing but once-thriving communities whose potential remain large and whose public, private, and civic sectors are fully committed—both from an engagement and financing perspective—to economic transformation?

We do this all by de-mystifying the Opportunity Zone capital stack and breaking it into digestible financing components. We learn together—from these three dozen voices and 400 practitioners—the emerging rubrics around the deal and the capital stack, the new and continuing roles of stakeholders, and the outcomes cities and states are incentivizing, along with the risks they’re hoping to mitigate.

We see these five compelling observations:

- The stack allows a much simpler financing for some community-enhancing projects, but the deals must "pencil."

- OZs bring a new type of investor to the community development table.

- Local governments have the rich and robust arsenal of incentives and risk mitigation devices that they’ve always had; now they just need to adapt them. Philanthropy can and should complement local government.

- CDFIs have an important role to play: partnering, innovating, and lending.

- There is an upside to the downside of limited guardrails: an opening for project intersectionality, and for new market-making impact measurement rubrics.